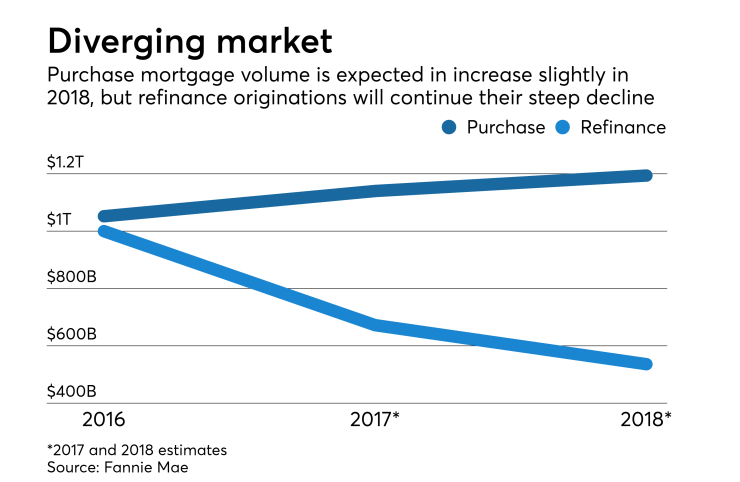

The first point on many mortgage originators' 2018 agendas will be looking for new sources to feed their lending machines and replace the continued drop-off in refinance activity.

"We have seen a pick up in the purchase market, but I feel like lenders have been saying that for the eight years," said Andrew Weinberg, the president of Silver Fin Capital, a mortgage broker located in Great Neck, N.Y. "While you can try to anticipate when purchases are coming, for us as a mortgage broker, I don't think you can rely on just purchase business to make up for what's been lost in the refi business because of higher rates."

That will lead to growth in the non-qualified mortgage space next year because there are plenty of people who are otherwise good borrowers, but don't qualify for traditional products. Silver Fin works with more than 50 wholesale lenders (well above the industry norm of three or four), and it has signed up with even more lenders because of their non-QM offerings.

"At this point it seems very fragmented in terms of what types of products and programs are out there, so we're digesting what the market has to offer," Weinberg said.

"I think non-QM will start to emerge more in 2018, not just because of volume pressure, but because the infrastructure — the compliance, the risk management, the infrastructure capabilities built over the last couple of years — will allow lenders in a very compliant, with an audit trail and in a risk adverse way of expanding the credit box," added John Vella, chief revenue officer at Altisource Portfolio Solutions.

Lower volume and tighter margins will create a recruiting opportunity for some firms, said Adam Thorpe, president and chief operating officer at Castle & Cooke, a Draper, Utah-based mortgage banker. While some first- and second-tier loan officers will become available as a result of companies closing, others are going to look for a new home because their needs are not being met.

Customers, referral partners and loan officers are all viewed as "stakeholders to the business. A stakeholder is anybody who has an interest in what we do," he said.

But a customer only does a handful of transactions in their lifetime. Referral partners bring in a couple of deals in a month.

"If you have a healthy relationship with a loan originator, those loan originators are going to be bringing you 10, 12, 15 deals a month," Thorpe said.

Even if a company survives on its own or in a merger, a loan officer could be looking for a new situation because they feel the culture that made them successful is at risk, he said.

Commercial originators will also be under pressure in 2018.

"A common theme [for success] is creativity and flexibility," said Larry Grantham, co-founder and senior portfolio manager of commercial real estate lender Calmwater Capital, located in Los Angeles. "Those will be beneficial to lenders. But they need to walk a fine line in balancing that in making sure the lender is not taking too much risk. That's difficult to do in an ever more competitive lending environment."