Cascade Financial Services has become the only manufactured housing loan-focused servicer currently rated by Fitch, adding signs of a rebound in factory-built home financing that could lead to new private securitization.

"The servicer rating positions Cascade for potential involvement in rated RMBS," Fitch said in a press release.

The company, which was founded in 1999 and acquired by Centerbridge Partners in 2016, received a rating of RPS3-minus from Fitch. Fitch rates residential primary servicers on a scale where the highest rating is 1 and the lowest is 5. Cascade has serviced its own originations since 2007.

"The rating reflects Cascade's modest but established position within the MH sector and recent portfolio growth, its experience management team, adequate risk control framework and technology upgrades," Fitch said.

Cascade expanded into third-party subservicing last year. Its servicing portfolio had 18,680 loans and an unpaid principal balance of $1.3 billion at year-end in 2018.

"While still relatively small, Cascade anticipates meaning growth in 2019 from additional third-party servicing of seasoned MH product and its own retail originations," Fitch said.

Fitch last rated a new-issue residential mortgage-backed securities deal secured by manufactured-housing loans in 2008.

Manufactured housing accounted for almost 10% of new homes in 2018 and that share is likely to grow this year, according to Fitch.

"While this product can be challenging to originate and service, the market has begun to focus on opportunities in this sector," Fitch noted.

Manufactured homes historically have required specialized servicing because they have depreciated at a faster rate than site-built homes and may not be secured by real estate, among other things. The majority of manufactured home loans are secured by personal property rather than real estate.

But homes today that qualify for Fannie Mae or Freddie Mac's new real estate-secured loans must be built to meet certain standards that could change that.

Fannie and Freddie also could enter the market for manufactured housing loans secured

Mortgage lenders also have been more interested in originating manufactured housing loans due to their potential to

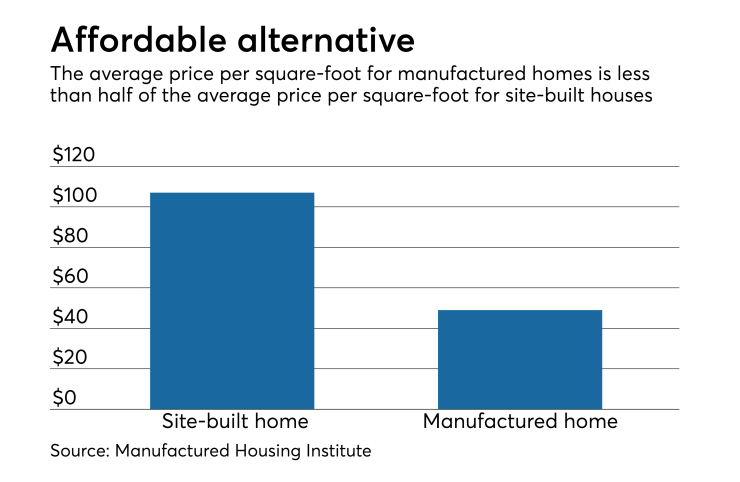

The average price per square foot for a site-built home is more than twice as high as the average price per square foot of a manufactured home, according to the Manufactured Housing Institute.