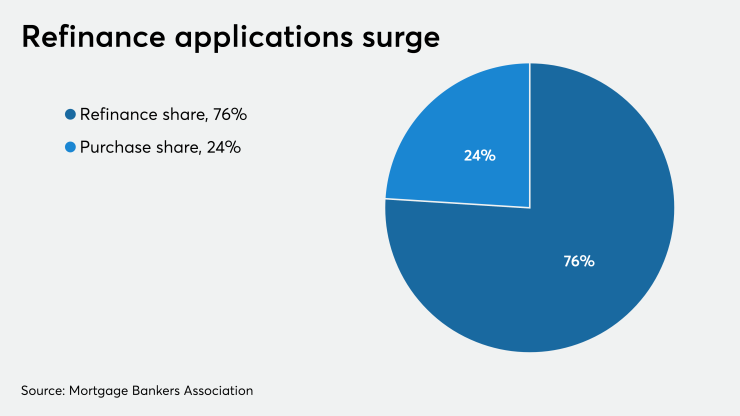

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

The MBA's Weekly Mortgage Applications Survey for the week ending March 6 reported a 79% increase in the refinance index

In response to the current interest rate environment, the MBA now forecasts total mortgage originations to come in around $2.61 trillion this year — a 20.3% gain from 2019's volume ($2.17 trillion). Refinance originations are expected to double from earlier MBA projections, jumping 36.7% to around $1.23 trillion. Purchase originations are now forecasted to rise 8.3% to $1.38 trillion.

"Market uncertainty around the coronavirus led to a considerable drop in U.S. Treasury rates last week, causing the 30-year fixed rate to fall and match its December 2012 survey low of 3.47%. Homeowners rushed in, with refinance applications jumping 79% — the largest weekly increase since November 2008," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "With last week's increase, the refinance index hit its highest level since April 2009. Prospective buyers continue to be encouraged by improving housing inventory levels in some markets and very low rates."

The seasonally adjusted purchase index increased 6% from one week earlier, while the unadjusted purchase index increased 7% compared with the previous week and was 12% higher than the same week one year ago.

"Taking into the account the current economic situation and how much rates have fallen, the MBA is nearly doubling its 2020 refinance originations forecast to $1.2 trillion, a 37% increase from 2019 and the strongest refinance volume since 2012. As lenders handle the wave in applications and manage capacity, mortgage rates will likely stabilize but remain low for now. This in turn will support borrowers looking to refinance or purchase a home this spring," Kan said.

While the 10-year Treasury yield dropped more than 30-year mortgage rates have, the resulting wider spreads "may persist given mortgage pipelines are likely at capacity so originators have little incentive to lower mortgage rates until their pipelines become a little less full," Keefe, Bruyette & Woods analyst Bose George said in a report.

Adjustable-rate mortgage activity decreased to 5.9% from 6.4% of total applications, while the share of Federal Housing Administration-insured loan applications decreased to 6.9% from 9.3% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 13.1% from 10.5% and the U.S. Department of Agriculture/Rural Development share decreased to 0.3% from 0.4% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased 10 basis points to history at 3.47%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400), the average contract rate decreased 5 basis points to 3.58%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 3.57% from 3.74%. For 15-year fixed-rate mortgages, the average decreased to 2.9% from 3.03%. The average contract interest rate for 5/1 ARMs decreased to 3.02% from 3.12%.