Sponsors of non-qualified mortgages collateralized in new securitizations are showing progress in moving borrowers out of pandemic-related payment deferrals as short-term forbearance programs expire.

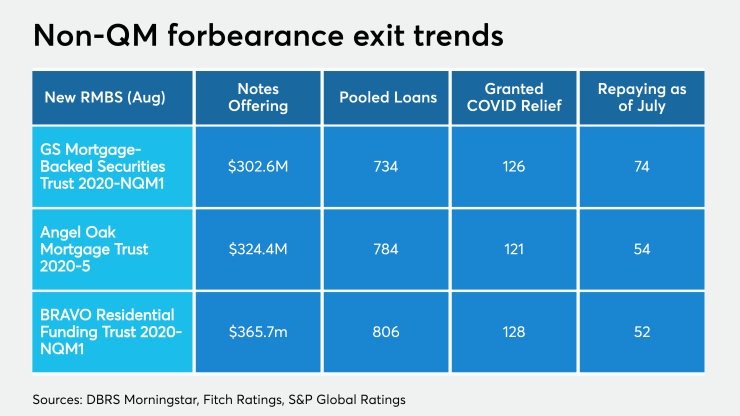

For example, Goldman Sachs Mortgage is sponsoring a $302.7 million RMBS pool in which nearly three-quarters of borrowers previously granted three-month payment holidays made their initial post-deferral housing payments for July, according to a report from DBRS Morningstar.

For pools of loans originated or acquired by Angel Oak and First Guaranty Mortgage Corp., the share of loans graduating from coronavirus-related forbearance shows less than half have entered paying status on their accounts since their deferrals expired, according to report data on new MBS deals each is sponsoring.

The borrowers affected within all three deals were enrolled in relief programs offered by their servicers. As private-label mortgage participants, these servicers were not subject to the COVID-19-related loan payment and eviction relief mandates under the federal Coronavirus Aid, Relief, and Economic Security Act signed into law March 27 for agency-backed qualified mortgages.

However, most were operating under state and local mortgage relief and foreclosure/eviction rules, prompting individual lenders/servicers to institute their own relief programs — most of them with highly variable characteristics for deferment allowances and repayment schedules.

According to presale reports, the new $302.5 million GS Mortgage-Backed Securities Trust 2020-NQM1 includes 126 loans (out of a total of 734) that have been granted relief on loans serviced primarily by Specialized Loan Servicing (handling 58.6% of the accounts) and Shellpoint Mortgage Servicing, owned by NewRez.

Approximately 56.7% of the loans were designated as non-qualified mortgages under the Consumer Financial Protection Bureau's ability-to-repay standards. The remainer are designated at QM Safe Harbor, QM rebuttal presumpion, along with loans to property investors (nearly 20% of the pool's asset balance) whose underwriting was subject to rental income of properties that not subject to qualified-mortgage standards.

DBRS Morningstar states that borrowers on 71.5% of those loans with forbearance in the Goldman deal made their July payments after a three-month deferral program ended. S&P Global Ratings noted that of the approximately 18% of loans granted deferrals in the pool, only 47 remain in active (including extended) forbearance. Another 39 loans remain in active deferral but lack ongoing forbearance.

Twenty-nine loans have completed forbearance programs, with 11 with no missed payments and 16 repaying missed payments.

Only two loans that completed forbearance are now considered delinquent, S&P reported.

For the $324.37 million Angel Oak Mortgage Trust 2020-5, the mostly non-QM portfolio (serviced by Select Portfolio Servicing) had 8.8% of borrowers (about 121 loans) who were on a coronavirus relief plan as of the Aug. 4 cutoff date of the deal. About one-fourth, or 2.4%, have extended the term of the relief plan and are considered four months delinquent.

Another 2.8% “have opted out of the coronavirus relief plan and are contractually current,” according to a report from Fitch Ratings.

For the $365.74 million BRAVO Residential Funding Trust 2020-NQM1 — a collection of primarily non-QM loans originated by First Guaranty, Caliber Home Loans and LoanStream Mortgage — 52 of 128 loans originally placed into a deferral plan have since made loan payments for July primarily to servicer Rushmore Loan Management Services.

Approximately 11.7% of the loans in the portfolio are considered late or in non-paying status, while 9.8% are in deferral but paying, according to a presale report from Fitch.

The status of deferred loans in non-QM pools is drawing more scrutiny because of the higher credit-risk involved with the pools, made up of loans made to borrowers who used alternative income sources to qualify, are purchasing rental properties or who have checkered credit histories.

(According to DBRS Morningstar and Fitch Ratings, some of the deferred loans in the Goldman Sachs and Angel Oak transaction included those issued as investor loans. For instance, about 0.43% of loans in the Angel Oak deal were loans to non-owner occupied homes).

In a report published this week, the RMBS team at DBRS Morningstar noted that mortgage delinquencies “may continue to stay at historically elevated levels in the coming months for many RMBS asset classes, particularly non-QM,” as economic strains of the pandemic continues and relief programs expire or are withdrawn by servicers.

About 7.21% of all mortgage loans (including agency loans) were in forbearance as of Aug. 9, the report stated, citing Mortgage Bankers Association data.