Want unlimited access to top ideas and insights?

Mortgage applications dipped as median home prices climbed and housing inventory continued to be squeezed. After rising 2.5% the week prior, the overall index decreased 2.5%, according to the Mortgage Bankers Association.

Purchase application volume led the decline. The seasonally adjusted purchase index decreased 5% from

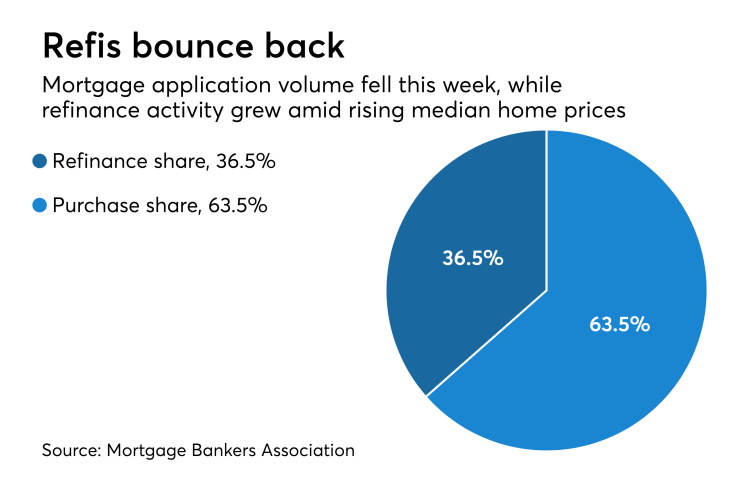

While total applications fell, the refinance index inched up 2% for the week ending July 13. The refinance share of application activity now stands at 36.5% of total volume, pulling up from its lowest share since August 2008.

"The mix of business changed, with FHA purchase volume increasing as conventional and VA volume decreased," said MBA Chief Economist Mike Fratantoni in a press release. "This indicates that more first-time buyers are entering the market, even as the market as a whole continues to be restricted by tight inventories of homes available for sale."

The latest

Adjustable-rate loan activity decreased to 6.1% from 6.3% of total applications.

The share of applications for Federal Housing Administration-guaranteed loans jumped to 10.6% from 10%, Veterans Affairs-guaranteed loans dropped to 10.2% from 11.3% and U.S. Department of Agriculture/Rural Development took a slight step down to 0.7% from 0.8%.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.77% from 4.76%. The average for 30-year fixed-rate mortgages with jumbo loan balances (greater than $453,100) declined to 4.66% from 4.68%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA lessened to 4.78% from 4.8%. The average for 15-year fixed-rate mortgages went up to 4.22% from 4.18%.

The average contract interest rate for 5/1 ARMs dropped to 4.12%, falling one basis point from its historical high mark last week.