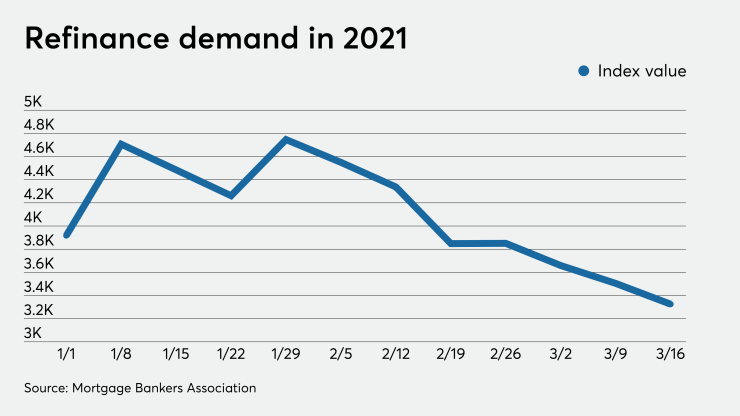

The latest weekly numbers for mortgage applications fell on a net basis even though demand for home purchases made up for some of the refinancing volume lost due to

Overall, apps dropped 2% on a

Refinancing activity is down 13% from 12 months ago, hitting a low not seen since September. In contrast, apps taken out by homebuyers were up 26% from late March of last year when the housing market was disarray and sorting out its initial response to the pandemic.

“Purchase applications were strong over the week, driven both by households seeking more

living space and younger households looking to enter homeownership,” said Joel Kan, MBA associate vice president president of economic and industry forecasting, in a press release.

The purchase share of the market in the last week tracked by the MBA was 39.1%, up from 37.1%.

Applications for Federal Housing Administration-insured loans plateaued at 11.7%, mortgages guaranteed by the Department of Veterans Affairs fell to 9.8% from 10.3% and financing the federal government provides for rural loans stabilized at 0.4%.

Adjustable-rate mortgages rose slightly to 3.2% from 2.7%