Interest rate swings during this past week resulted in a decline in both refinance and purchase mortgage applications compared with the previous period, according to the Mortgage Bankers Association.

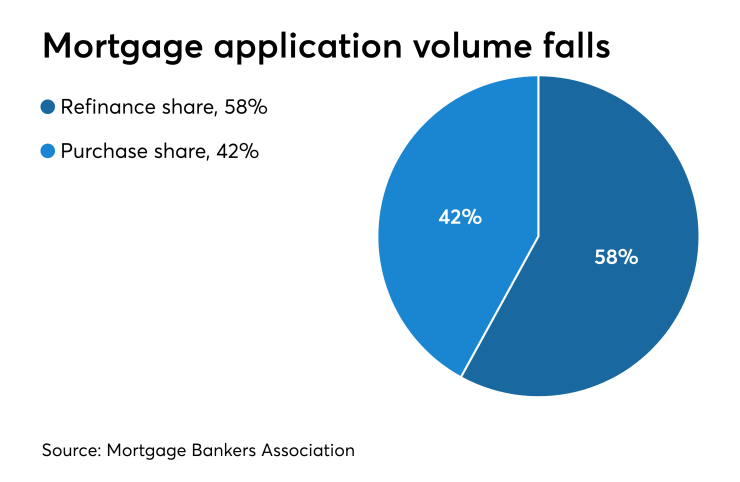

The MBA's Weekly Mortgage Applications Survey for the week ending Oct. 18 found that total application volume was down 11.9%, led by a 17% drop in the refinance index

Meanwhile, the seasonally adjusted purchase index decreased 4% from one week earlier. The unadjusted purchase index decreased 4% compared with the previous week and was 6% higher than the same week one year ago.

"Interest rates continue to be volatile, with Brexit votes and ongoing trade negotiations swinging rates higher or lower on any given day," Mike Fratantoni, the MBA's senior vice president and chief economist, said in a press release. "Last week, mortgage rates jumped 10 basis points and

Even with the shifting interest rate environment, there is still good news in the purchase index data, he said.

"Although purchase applications declined, application volume is still running about 6% ahead of this time last year. Low mortgage rates continue to fuel buyer interest, but supply and affordability challenges persist," said Fratantoni.

Adjustable-rate mortgage share activity decreased to 4.8% from 5.5% of total applications and the share of Federal Housing Administration-insured loan applications increased to 12.1% from 11.3% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 13.5% from 12.9% and the U.S. Department of Agriculture/Rural Development share increased to 0.5% from 0.4% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased 10 basis points to 4.02%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $484,350), the average contract rate increased 6 basis points to 3.96%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased 2 basis points to 3.79%. For 15-year fixed-rate mortgages, the average increased 7 basis points to 3.39%. The average contract interest rate for 5/1 ARMs decreased to 3.29% from 3.37%.