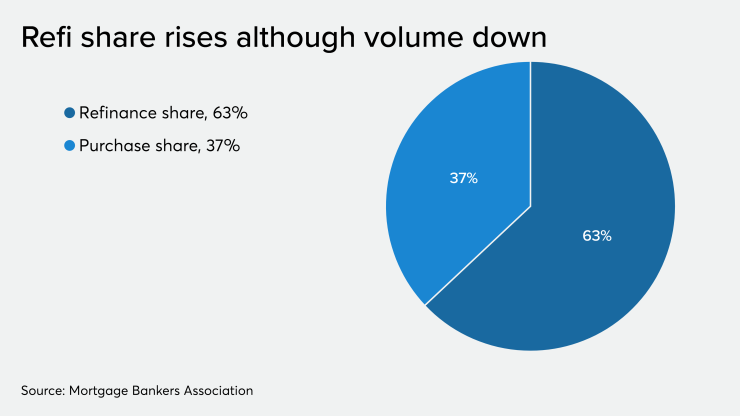

Mortgage applications decreased 5.3% on a seasonally adjusted basis from one week earlier led by a decline in conventional refinance loan demand, according to the Mortgage Bankers Association.

The MBA's Weekly Mortgage Applications Survey for the week ending Dec. 20 found that the refinance index decreased 5%

"The 10-Year Treasury yield increased last week amid signs of stronger homebuilding activity and solid consumer spending, leading to a rise in conventional conforming and jumbo 30-year mortgage rates to just under 4%" Mike Fratantoni, the MBA's senior vice president and chief economist, said in a press release. "With this increase, conventional refinance application volume fell 11%. Refinance applications for government loans did increase, even though rates on FHA loans picked up. The change in the mix of business has kept the average refinance loan size smaller than we had seen earlier this year."

Home buying activity slowed as the holiday season nears its peak, which resulted in a 5% seasonally adjusted decline in the purchase application index. On an unadjusted basis, purchase volume was down 7%.

"We are in the slowest time of the year for the purchase market. Purchase application activity declined after the seasonal adjustment, but still remains about 5% ahead of last year's pace. The increase in construction activity will bolster housing inventories, which should be a positive for purchase volumes going into 2020."

Adjustable-rate mortgage activity decreased to 4.1% from 4.6% of total applications and the share of Federal Housing Administration-insured loan applications increased to 14.5% from 13.7% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 15.2% from 12.9% and the U.S. Department of Agriculture/Rural Development share remained unchanged at 0.5% from the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased 1 basis point to 3.99%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $484,350), the average contract rate increased 1 basis point to 3.97%.

For 30-year fixed FHA-insured mortgages, the average contract interest rate increased 8 basis points to 3.87%. Bucking the rising rate trend, the average for 15-year fixed-rate mortgages decreased 1 basis point to 3.39%. The average contract interest rate for 5/1 ARMs increased to 3.38% from 3.28%.