Mortgage applications were up 2.9% from one week earlier, even as the rate for the 30-year conforming mortgage reached its highest point in over seven years, according to the Mortgage Bankers Association.

The MBA's Weekly Mortgage Applications Survey for the week ending Sept. 21 found that the refinance index increased 3%

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased 9 basis points to 4.97%, its highest point since April 2011.

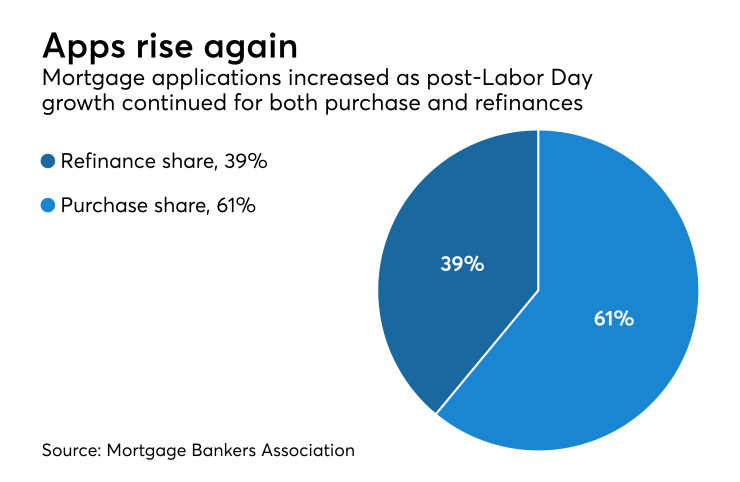

The refinance share of application activity increased to 39.4% from 39% the previous week.

"Rates rose last week as investors looked past U.S.-China trade tariffs and towards this week's Fed meeting," Joel Kan, the MBA's associate vice president of industry surveys and forecasts, said in a press release. "Treasury yields increased 8 basis points for the week as the growth outlook for the U.S. remained positive and data on housing starts and home sales showed a reprieve after a few months of weak results."

"Mortgage applications also increased as post-Labor Day growth continued for both purchase and refinances," he said.

The seasonally adjusted purchase index increased 3% from one week earlier. The unadjusted purchase index increased 2% compared with the previous week and was 4% higher than the same week one year ago.

Adjustable-rate loan activity remained unchanged at 6.5% of total applications, while the share of Federal Housing Administration-guaranteed loans decreased to 10.4% from 10.6% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 10.1% from 10% and the U.S. Department of Agriculture/Rural Development share remained unchanged at 0.7% from the week prior.

For 30-year fixed-rate mortgages with jumbo loan balances (greater than $453,100), the average contract rate increased 15 basis points to 4.92%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased 4 basis points to 4.94%, while for 15-year fixed-rate mortgages the average increased 8 basis points to 4.38%.

The average contract interest rate for 5/1 ARMs increased to its highest level in the history of the survey, 4.22% from 4.17%.