After declining for two consecutive weeks to

The market composite index, which tracks mortgage application activity through a survey of MBA members, jumped a seasonally adjusted 16% week-over-week for the period ending July 9. The week’s numbers included an adjustment for the July 4th holiday. The unadjusted index, however, came in 7% lower. Compared to the same week one year ago, seasonally adjusted volume showed a decrease of 10.8%.

Both refinances and purchases contributed to the weekly upswing. The refinance index climbed 20% over the prior week and was 29% lower than the same week in 2020. The Purchase Index posted a seasonally adjusted 8% increase from one week earlier, while on an unadjusted basis, the index registered a 13% decline in volume. The unadjusted Purchase Index was 29% lower from its level suring the same week last year.

“Treasury yields have trended lower over the past month as investors remained concerned about the COVID-19 variant and slowing economic growth,” Kan said in a press statement.

The rise in refinances was reflected in their total share of mortgage activity. Refinancing loans accounted for 64.1% of volume, up from 61.6% a week earlier.

Adjustable-rate mortgage applications also took a slightly larger share, accounting for 3.5% of overall volume, compared with 3.3% the previous week.

Average size of refinances increases; purchases shrink

The uptick in refinance activity was accompanied with a noticeable rise in refinance size. The average price of a refinance application climbed above $300,000 for the first time in three weeks to $316,300, up 8.6% from $291,200 one week earlier. But average purchase sizes fell, even as applications picked up. The average purchase-application size decreased to its lowest level since January, falling to $398,600 from the previous week’s $405,300, a 1.7% drop. It was only the second time since mid-April that the weekly average purchase size had fallen below $400,000.

“We continue to see ebbs and flows as housing demand remains strong, but for-sale inventory remains low. However, lower rates may be helping some home buyers close on their purchases, especially first-time home buyers,” Kan said.

Despite the decline in purchase size, the average size of mortgage loans overall for the week climbed to $345,900 from $335,400, up 3.1%.

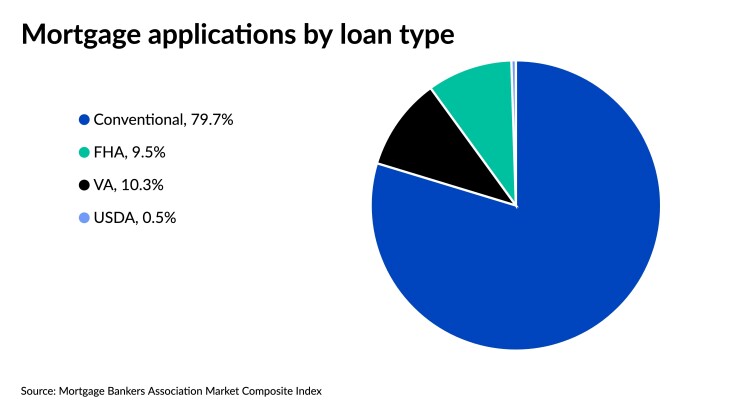

The share of applications coming through government programs accounted for a smaller share of overall volume week-over-week. Federal Housing Authority-sponsored loans equaled 9.5% of all applications, down from 9.8% the prior week. Veterans Administration-backed applications decreased to 10.3% of total volume, down from a 10.8% share a week earlier, while the percentage of U.S. Department of Agriculture loans remained the same at 0.5% of total applications.

Interest rates fall further, with 30-year rate at its lowest in months

The rise in mortgage activity corresponded with a decline in most major interest-rate types for the week.

- The average contract interest rate of 30-year fixed-rate mortgages with conforming loan balances of $548,250 or less fell six basis points to 3.09%, the lowest it's been since mid February. A week ago, the rate came in at 3.15%.

- The average contract interest rate of 30-year fixed-rate jumbo loans (with balances greater than $548,250) dropped to 3.16%, compared to 3.2% the prior week.

- The average contract interest rate of 30-year fixed-rate mortgages backed by the Federal Housing Authority decreased to 3.15%, a two-basis-point decrease from 3.17% the previous week.

- The average contract interest rate of 15-year fixed-rate mortgages dipped to 2.48%, compared to 2.52% the previous week.

- The interest rate for 5/1 adjustable-rate mortgages showed the only weekly increase, climbing to 3.02% from 2.94%.