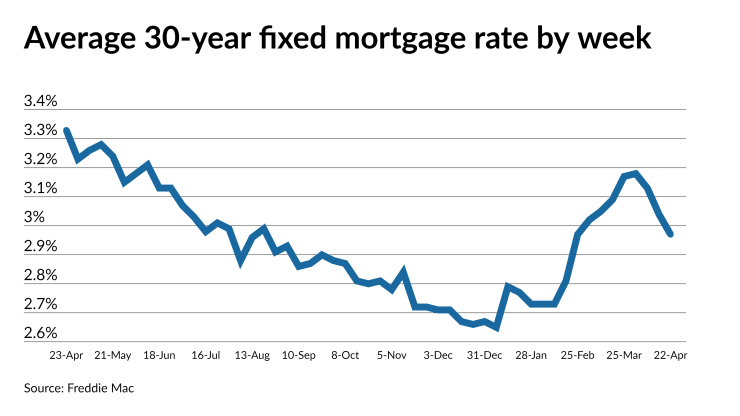

With heightened demand for treasuries putting downward pressure on yields, mortgage rates fell for the third straight week, likely giving borrowers a short window to take advantage of sub-3% rates before a reversal comes.

After reaching a 2021 high

Treasury yields declined despite strong strong economic data and consumer confidence following stimulus payments, suggesting that increased COVID-19 cases could have reduced investor tolerance for risk, Zillow economist Matthew Speakman said in a statement.

However, this will likely be a short reprieve

“Despite another weekly downtick, the longer-term trend for mortgage rates remains to the upside and barring a significant economic or pandemic-related setback, it’s unlikely that this downward movement in rates will continue for an extended period,” Speakman said.

The average 15-year FRM fell to 2.29% from 2.35% one week earlier and 2.86% one year ago. Meanwhile, only the 5-year Treasury-indexed adjustable rate mortgage saw growth, averaging 2.83% from 2.8% the week prior but dropped from 3.28% annually.