Want unlimited access to top ideas and insights?

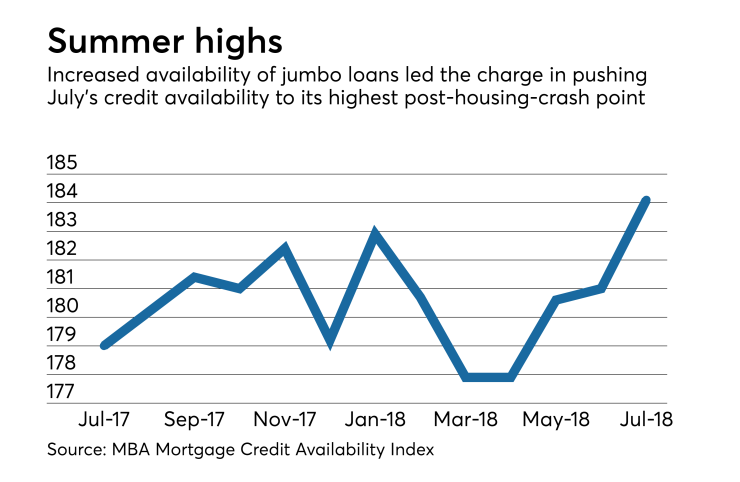

Mortgage credit accessibility kept climbing in July, mostly thanks to an expansion of jumbo loan products offered, pushing the jumbo index to its historical high point, according to the Mortgage Bankers Association.

The MBA's Mortgage Credit Availability Index grew 1.7%, adding 3.1 percentage points

"Credit availability continued to expand, driven by an increase in conventional credit supply. More than half of the programs added were for jumbo loans, pushing the jumbo index to its fourth straight increase, and to its highest level since we started collecting these data. There was also continued growth in the conforming nonjumbo space, which reached its highest level since October 2013," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

The overall loosening of credit could stoke the purchasing and refinancing flames of the housing market.

The conventional MCAI grew 4.2% and the government MCAI decreased 0.4%. Both of the component indices within the conventional MCAI jumped, the jumbo by 5.8% and the conforming by 2%.

The index tracks changes in a variety of underwriting criteria, like credit score requirements and loan-to-value ratios, to show relative changes in industrywide credit risk and access to mortgages. The index is calculated by the MBA using loan program data from Ellie Mae's AllRegs Market Clarity database.