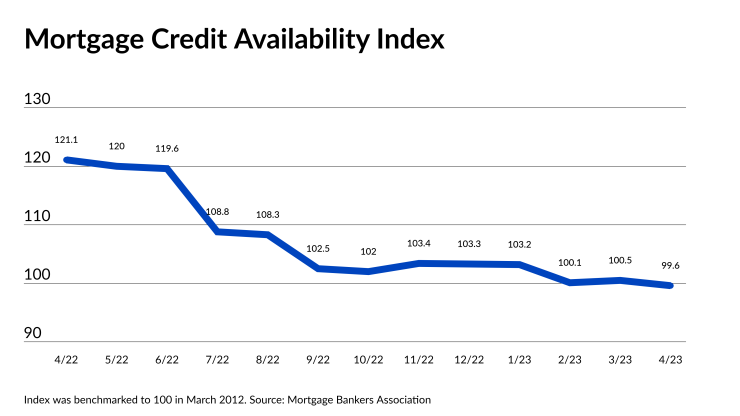

Mortgage lending conditions during April tightened to the lowest level in over a decade, a pull-back related to

Its Mortgage Credit Availability Index fell to 99.6, the lowest level since January 2013, a drop of 0.9%

Besides the issues that resulted in multiple bank failures in recent weeks,

"The contraction was driven by reduced demand for loan programs such as certain adjustable-rate mortgages loans, cash-out and streamline refinances, and those with lower credit score requirements," said Joel Kan, the MBA's deputy chief economist, in a press release. "Government credit supply decreased for the third consecutive month, as industry capacity continues to adjust to significantly reduced origination volume, along with the expectations of a weakening economy later this year."

The government MCAI was down by 2.1% versus the prior month.

The conventional MCAI increased by 0.5% on a month-to-month basis, led by a 1.5% increase in the jumbo component, a program that many banks, including

But the housing shortage is impacting the market more than what lenders are willing to do.

"Even

MBA introduced the MCAI in June 2013, with analysis of data back through April of the prior year; it used less complete information to calculate the index back through June 2004.

It uses credit score, loan type, loan-to-value ratio and other information from over 95 lenders/investors obtained from ICE Mortgage Technology.