Better credit quality and the influx of refinancing during the low interest rates of the last few years pushed mortgage performance to the highest levels since the turn of the century, according to Black Knight.

Foreclosure starts hit an 18-year low in 2018, totaling 576,000 — a year-over-year drop of 11%. However, December's 46,300 starts was an annual increase of 4% for the month and a

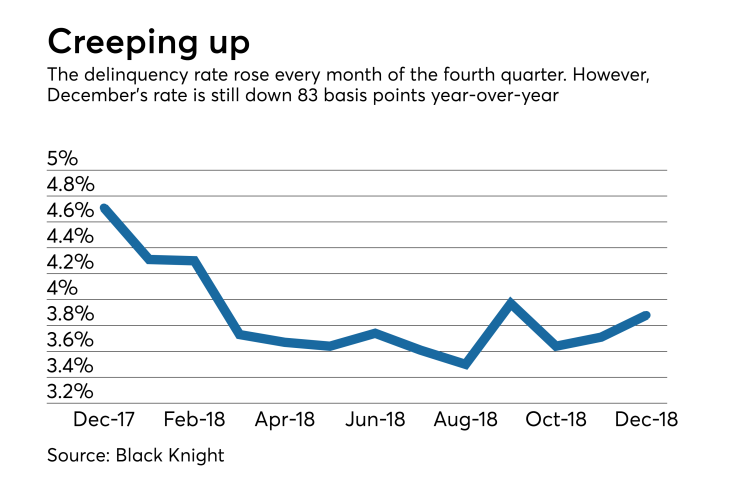

Delinquency rates crept up in December to 3.88%, but still sit below the 4.71%

"Across the board, 2018 year-end numbers are good news from a mortgage performance perspective," Ben Graboske, executive vice president of Black Knight's data and analytics division, said in a press release. "All four major performance metrics — delinquencies, serious delinquencies, active foreclosures and total noncurrent inventory — ended the year below prerecession averages for the first time since the financial crisis."

Seriously delinquent mortgages — those late in payment by 90 days or more — dropped to 1.51% from 2.06% in December 2017, a change of 26.89%. They did, however, edge up from last month's rate of 1.5%.

The year-end numbers reflect the healthier atmosphere mortgages incubated in since the housing bubble.

"The high credit quality and corresponding lower risk we've seen in the post-crisis origination market for the better part of a decade continues to pay dividends in terms of mortgage performance. In addition, the low interest rate environment we've enjoyed for so long had — until very recently — resulted in a refinance-heavy blend of originations for years," said Graboske.

By-and-large, refinances perform better than purchases since borrowers lock in a lower interest rate with their refis. The low unemployment rate also helped consumers make their payments on time.

"We've had the benefit of strong employment and housing markets, which have helped the vast majority of homeowners meet their debt obligations, while those few who may have faced a possible default have gained enough equity to be able to sell rather than face foreclosure," Graboske continued.