Want unlimited access to top ideas and insights?

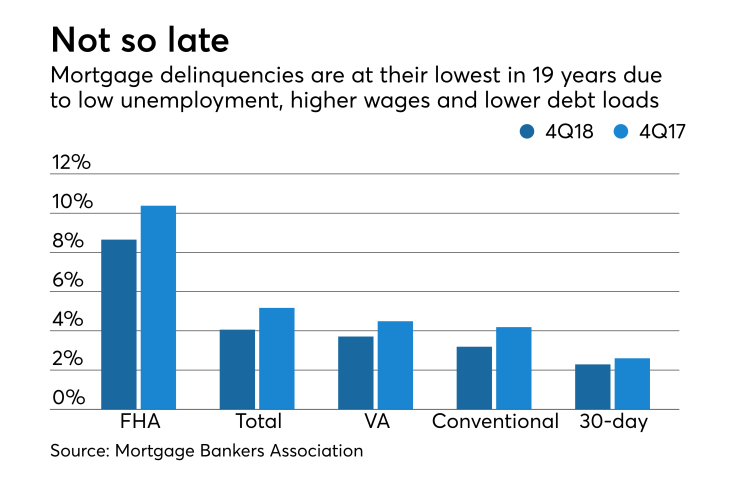

Mortgage delinquencies in the fourth quarter were at their lowest level in nearly 19 years, helped by wage growth, low household debt and low unemployment, the Mortgage Bankers Association said.

The delinquency rate for single-family mortgage loans decreased to a seasonally adjusted rate of 4.06% of all loans outstanding,

Even more impressive was that the drop was across all loan types and all stages of delinquency, Marina Walsh, the MBA's vice president of industry analysis, said in a press release.

The conventional loan delinquency rate was 3.19%, down 37 bps from the third quarter and 100 bps from one year prior. For Federal Housing Administration-insured loans, the rate was 8.65%, down 31 bps from the previous quarter and 173 bps from the previous year, and for Veterans Affairs loans, the rate of 3.71% was down 45 bps and 78 bps, respectively.

"With the unemployment rate near a 50-year low, wage growth trending higher and household debt levels relative to disposable incomes at a 35-year low, homeowners are in great shape, and mortgage performance is quite strong," Walsh said.

The delinquency rate improved in states that were affected by natural disasters in the fourth quarter of 2017. For Florida, the delinquency rate fell 458 basis points, while in Texas it was down 218 basis points.

And when it came to more recent incidents, "Florida's Hurricane Michael in October, as well as the California fires in November, have had limited impact on the overall delinquency rates in those states," said Walsh.

Even states that were affected by storms in the third quarter of 2018, like North Carolina, South Carolina, Mississippi, Arkansas and Alabama, all showed improvement in the most recent period.

If there was any negatives, it was foreclosure starts increased by 2 basis points between the third and fourth quarters to 0.25%.

This increase was driven by the lifting of moratoriums in states affected by natural disasters, along with severely delinquent loans that finally moved into the foreclosure process, especially in judicial states, Walsh said.

The serious delinquency rate, loans that are 90 days or more past due or in the process of foreclosure, was 2.06%, down 7 bps from the third quarter and 85 bps from the fourth quarter of 2017.

Loans 30 days past due saw a seasonally adjusted decline to 2.29% in the third quarter and 2.6% for the fourth quarter of 2017.