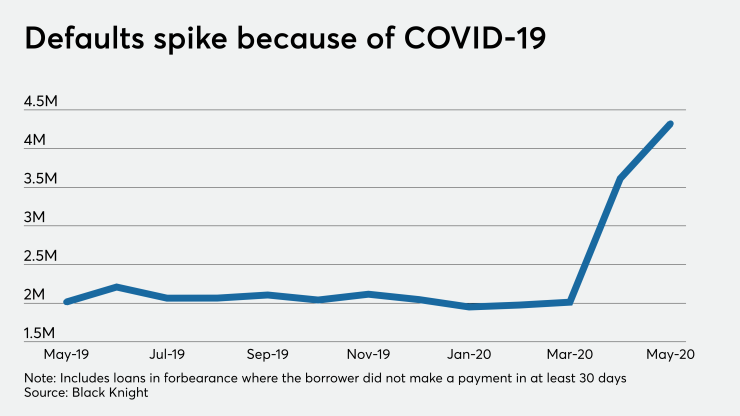

The number of mortgage borrowers who have missed a loan payment has more than doubled in two months, according to Black Knight.

There were 4.3 million borrowers who were at least 30 days late on their mortgage payment or were already in foreclosure at the end of May, according to Black Knight. This was up from 3.6 million in April and

Black Knight's loan delinquency calculations include borrowers who are already in a forbearance program but did not make their scheduled monthly payment.

The delinquency rate, which does not include loans in foreclosure was 7.76% for May. That is the highest level in eight-and-a-half years.

This is compared with 6.45% for April, 3.39% for March and 3.36% for May 2019, which at the time

As of June 15, only 15% of all mortgage borrowers paid as due for this month, Black Knight's McDash Payment Tracker found.

Still, that is a higher share of payments than the amount that had been made by

In May, 28% of forborne borrowers made their payment, while in April, it was 46%.

Meanwhile, the number of borrowers who were late on their payments for 90 days or greater also saw a significant increase over the past two months. This grouping consists of borrowers who were already delinquent on their mortgages before the coronavirus shutdown began.

At the end of May, there were 631,000 loans for which a payment had not been made for at least 90 days. In April, it was 462,000, in March, it was 406,000, and in May 2019, it was 461,000.

The share of borrowers that were in foreclosure in May was at its lowest level in the 20 years — since Black Knight started reporting this metric. However, that was due to moratoriums established under the federal coronavirus relief legislation as well as by various states.

The total foreclosure presale inventory rate was 0.38%, down 5.8% from April and 22.7% compared with May 2019.

Given that there are

May's mortgage prepayment rate of 2.29% was 1.78% lower than April's — which was the highest in 16 years — but over 86% above what it was for May 2019.

"COVID-19-related impacts on April purchase and refinance locks resulted in mortgage prepayments edging downward, but with 30-year rates