What a difference a year can make. At this time in 2020, mortgage

The latest Mortgage Monitor showed 217,000 homeowners became delinquent on their home loans in March, an all-time monthly low and down from 429,000 in February. The

“The distribution of 159 million stimulus payments totaling more than $376 billion, broader economic improvement leading to nearly a million new jobs and 1.2 million forbearance plans reviewed for extension or removal resulted in an 11% decline in plan volumes in the last 30 days,” Ben Graboske, president of data and analytics at Black Knight, said in a press release.

Prepayment activity spiked to a 17-year high as

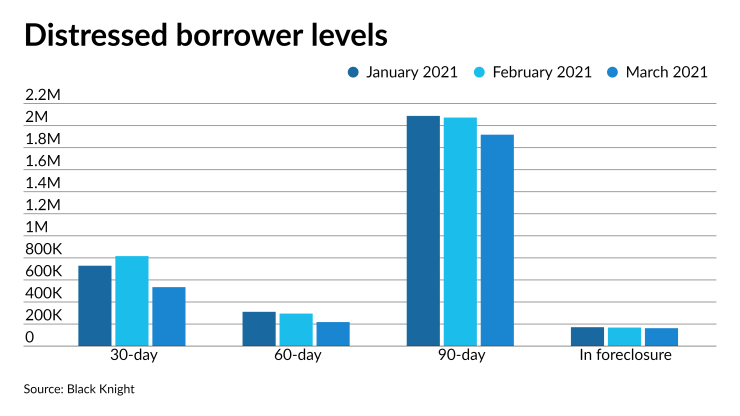

Meanwhile, 90-day delinquencies declined to 1.92 million from February’s 2.07 million. However, the number is five times higher than its pre-pandemic level due to the swaths of consumers still facing hardships, borrowers choosing to remain under forbearance protection and a number of borrowers who remain under protection

Foreclosure starts surged 28.2% month-over-month to 4,961 from 3,887 while active foreclosures dropped to another record low of 162,329 from 167,944 in February. March 2020 starts totaled 27,585 and active plans hit 220,271. However, policies around foreclosure continue to be fluid, as governing