The percentage of home loans with late payments is unlikely to fall much further in 2020 when mortgages made to

"What we've been seeing is, even with the fact that we've had growing debt levels, consumers are still performing well on the debt they have outstanding," said Matt Komos, a vice president in TransUnion's financial services research and consulting unit. "I think many lenders in the mortgage space are still pretty conservative. We have seen some opening up [in nonprime credit] in the last couple of years and we anticipate that to continue, but nothing compared to what we saw just after the recession."

Because of the here-to-fore tighter underwriting standards, the widening of credit guidelines should have a minimal impact on delinquencies.

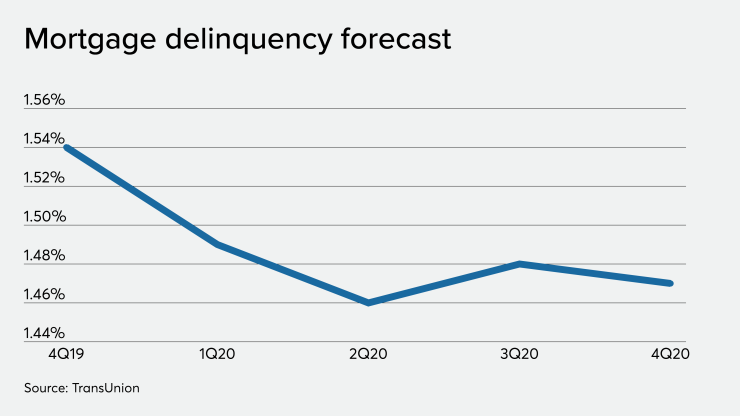

TransUnion's consumer-credit forecast suggests that quarterly percentage of mortgage borrowers 60 days or more past due will fall slightly at the beginning of the year to 1.49% from 1.54% and thereafter remain relatively stable at levels between 1.46% and 1.49%.

The share of personal and auto loans delinquent by 60 days or more, and the 90-plus-day delinquency rate for credit cards, also are expected to remain largely flat in 2020.

The range of delinquency rates in the fourth quarter of 2020 projected for each category are as follows: auto, 1.24% to 1.44%; credit card, 1.77% to 2.01%; and personal loans, 2.98% to 3.34%. TransUnion does not measure student loan delinquency rates due to distortions in the data caused by deferrals.

Fintech lending is fueling some significant growth in the personal loan sector, which has the highest delinquency rate of all the categories of consumer debt TransUnion tracks. But the percentage of borrowers who have outstanding debt in this category remains small, according to Komos.

"The unsecured personal loan market has tripled in not too long of a time frame, but what's interesting is that only 7% of consumers have an unsecured personal loan," he said.