It’s been a year-plus since widespread forbearance arrived and it’s gone a long way toward reducing distress, but a recent estimate for the equity held by borrowers with hardships suggests the financial duress remaining is likely to create some limited

The drop in the forborne-payment rate to nearly 5% earlier this year from a peak of 7% in May 2020 is promising when it comes to future mortgage performance, a Government Accountability Office report finds. But roughly 1.9% of distressed borrowers may be at risk of

Borrowers

"Areas such as parts of New Jersey, Connecticut, Maryland, Illinois, New York, Louisiana, and Washington, D.C., look like they include some people who have negative equity and in forbearance," said Selma Hepp, deputy chief economist at CoreLogic. “Those are the states where will may see a little bit of a blip in distressed sales.”

Some of these regions are facing additional distress that may not be related to the coronavirus.

“We see that areas along the Gulf Coast, not only because of the pandemic because of the loss of oil jobs and hurricanes, have the highest delinquency rates,” Hepp said in an interview.

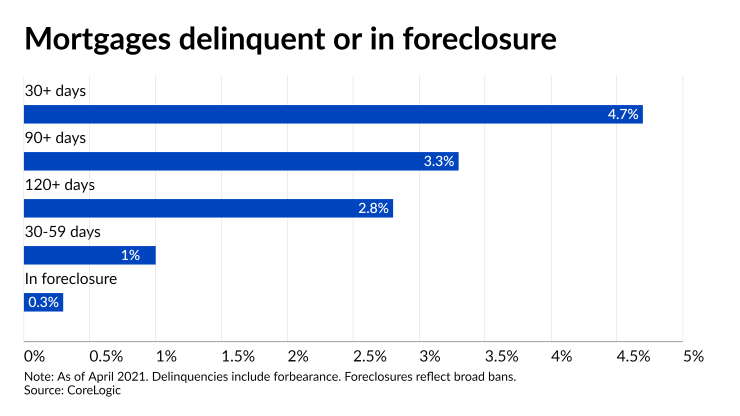

However, areas like Lake Charles, La. — which experienced a 0.8% annual increase in its delinquency rate for April to 7.8% — are unusual. Overall delinquency rates in April were improved year-over-year for the first time since March 2020 at 4.7% compared to 6.1% a year earlier, according to CoreLogic.

Also, recent statistics increasingly confirm foreclosures should be far lower than the last time the nation recovered from an economic shock.The 1.9% share of distressed borrowers with no or negative equity now is far lower than during the prior foreclosure crisis back in 2011, when it was in double-digits, the GAO noted.

The wide use by borrowers of the forbearance option available on government-related mortgages, in addition to generally strong equity levels are to thank for that, according to the GAO study. Only 0.5% of federally backed loans were delinquent but not in forbearance, February data from the National Mortgage Database shows. (The database contains a nationally representative 5% sample of home loans in the United States.)

“A lot of strides have been made to prevent foreclosures from happening and we really don’t see a wave like last time. It is more like a blip,” said Hepp.