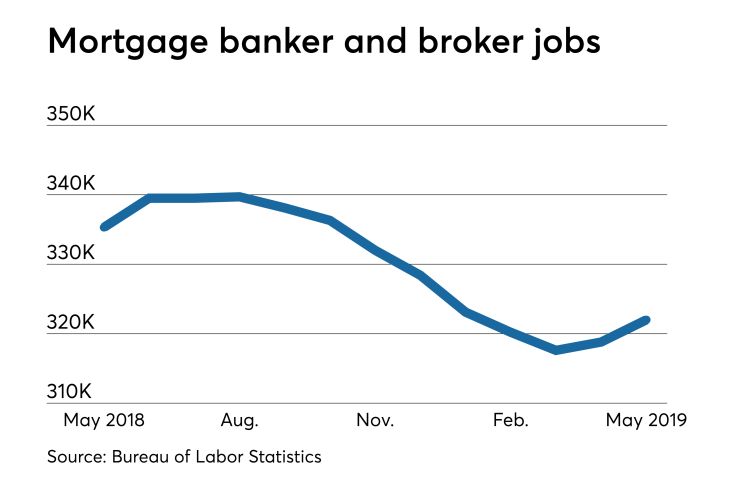

After months of backsliding followed by a modest increase in April, nondepository mortgage companies added 3,200 workers in May, as the overall job market gained steam.

Workers employed by nonbank mortgage bankers and brokers during the month totaled 322,000, according to the Bureau of Labor Statistics. It's

Overall employment — which the BLS releases a month ahead of the industry-specific reports — saw a major boost in June, possibly indicating a similar fate for nonbank mortgage jobs.

"This morning's robust jobs report should ease some of the pressure that the Fed faces to cut rates at the upcoming July FOMC meeting," Doug Duncan, Fannie Mae chief economist, said in a statement.

"The report showed nonfarm payrolls increasing by 224,000 in June, outweighing small downward revisions to the prior two months and indicating that the labor market remains a strength of the economy. Payroll growth has averaged 171,000 over the last three months, the average workweek remained steady at 34.4 hours, and average hourly earnings continue to grow at a strong year-over-year pace of 3.1%."

Of the sectors with enlarged job growth, increased construction employment adds another positive indicator for housing finance prospects and could help address the home inventory shortage.

"Construction employment rose 21,000 this month and residential construction increased by 6,000 jobs (including specialty trade contractors), which should help to lessen some of the supply constraints faced by homebuilders," said Duncan.

The rising labor force participation in June led to an uptick in unemployment. However, the 3.7% rate still hovers near 50-year lows.