Mortgage consolidation continued full steam at the start of 2026 with Pennymac's purchase of Cenlar's subservicing business, but executives at an industry conference this week had mixed views on its outlook and pace going forward.

Last year's megadeal combination of

"I think people's mindset changed around the values of their organization based on the execution of that transaction," he said. "So I think for a period of time we saw challenges in terms of buyers and sellers agreeing to valuation."

"There was a lot of strategic value to a Rocket-Cooper transaction, right? They really bring different pieces of the puzzle in the mortgage space together," he said.

This is in line with Freedom's outlook on acquisition activity, Sheeler said.

"We think we're extremely well positioned. If something comes up that fits our wheelhouse and fits the way our organization works, of course, we're going to look at it," he said.

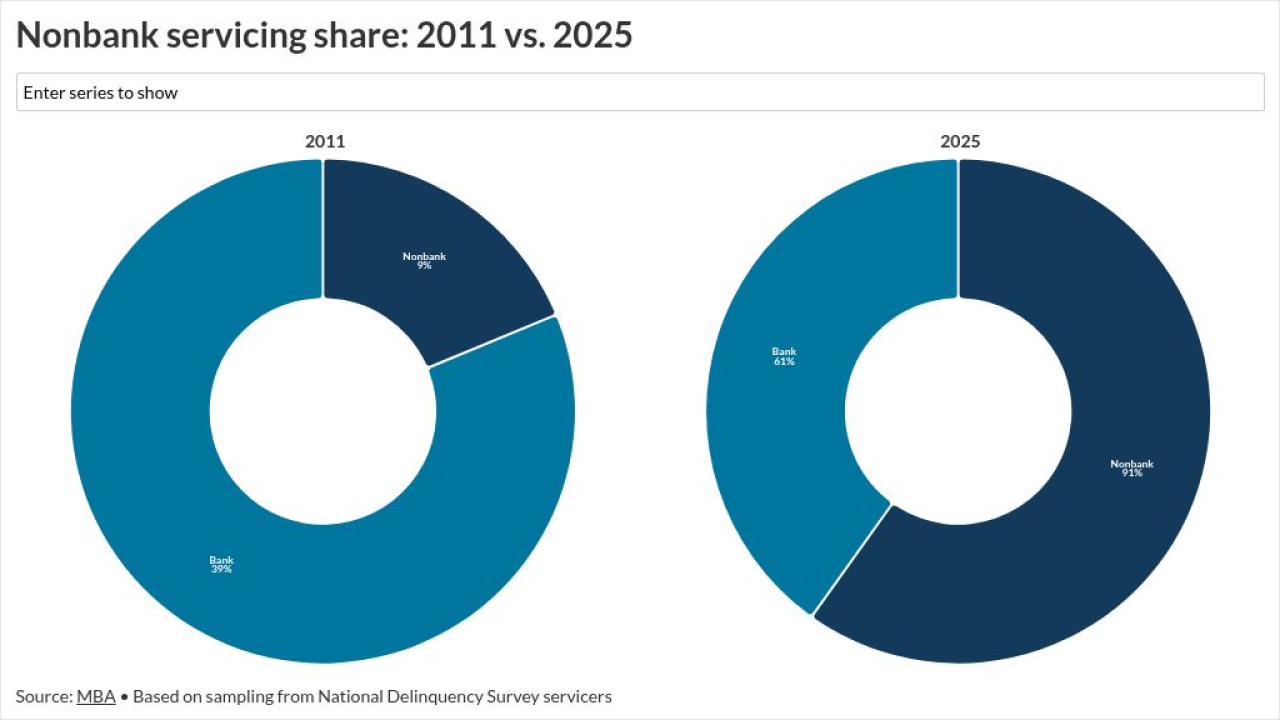

The selective view of acquisitions in the industry provides a reason to question whether the M&A trend shifting more servicing to nonbanks in particular continues. (Cenlar is a bank but Pennymac plans to shed that charter when it acquires the subservicing business.)

"I'm not expecting a flurry of acquisitions in 2026," he said.

However, he noted that the market could always prove him wrong, including another related sector within servicing where M&A may be active this year.

"As we go into a different environment, an environment that is going to have more delinquency, more default, more forbearance - I think different vendors are seeing different opportunities there, and you're seeing consolidation in that space," Sheeler said.

Panelists and other experts also have indicated plans for

Why the M&A wave may not be over yet

Jason Kwasny, chief servicing officer at ServBank, showed more confidence that broader nonbank mortgage servicer combinations would persist.

"You'll continue to see a lot of consolidation," he said.

Krasny attributed this to one key driver.

Acquirers are betting "if they can control that entire experience from the time that they start to originate all the way to the end, they're increasing their

Speaking as part of the same panel, Cenlar FSB Chief Operating Officer Leslie Peeler said the sale of her company's subservicing business to Pennymac has advantages in pairing her company's expertise in that area with its acquirer's technology platform.

"When we look out to the future and the importance of scalability and operating effectively and operating compliantly, all of those things together make it a really great marriage," Peeler said.

Another trend execs are eyeing: Insurance issues

Peeler also weighed in a question about the extent to which insurance cost challenges in the industry play into pockets of delinquency emerging from financial stress on homeowners during the industry executives' panel.

"It's not happening by itself, right? You've got a myriad of other issues that are happening at the same time that are impacting affordability," she said, while noting other stressors that exist like artificial intelligence's impact on jobs, and rising consumer costs for energy or property repairs.

Insurance availability and recent rule changes that impact it also are challenging servicers, Michelle Valentine, senior vice president, compliance, National General Lender Services, noted on a separate panel Wednesday afternoon that was dedicated to the topic.

A new rule in Nevada has meant explaining to borrowers that, while the state has allowed insurers to exclude wind coverage, "it doesn't mean lenders will allow you to," Valentine said.