At the end of May, the lowest number of mortgages started the forbearance process in a week since the pandemic started, according to Black Knight.

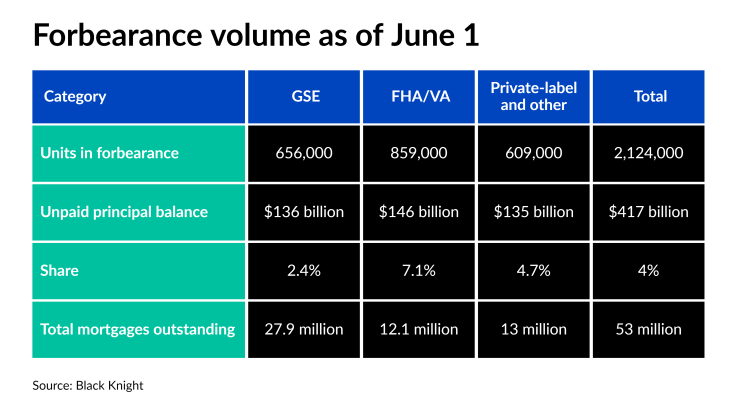

Following back-to-back weekly increases of 16,000 loans entering the process, outstanding loans in forbearance dropped by 71,000 to 2.124 million as of June 1 from 2.195 million one week prior. These delinquent borrowers account for 4% of the 53 million active mortgages in the market and combine for an unpaid principal balance of $417 billion, down from $431 billion week-over-week.

“The limited number of forbearance plan starts this week was due to both broad overall economic improvement generally and mortgage performance improvements more specifically, but also the shortened holiday week resulting in one less day for plans to be initiated,” Andy Walden, Black Knight's director of market research, told NMN.

About 65,000 plans scheduled to expire in May remain unaccounted for, which could lead to another big decrease next week. Additionally,

By loan type, those backed by Fannie Mae and Freddie Mac decreased by 26,000 week-over-week, falling to a total of 656,000. Government-backed mortgages — sponsored by the FHA and VA — led the overall decline with a 28,000 drop to 859,000 overall. Portfolio and private-label securitized loans — which do not fall under