There is a rosy employment outlook for lenders in 2016, as an elevated volume of homes available spurs growth in purchase loans.

The Mortgage Bankers Association projects that the volume for purchase originations will rise by 22% next year, to nearly $1 trillion, while refinance activity is expected to fall by about 20%, to less than $500 billion.

The mortgage industry's workforce should also evolve as more borrowers look to buy homes, rather than refinance, says Mike Fratantoni, the association's chief economist. Employees currently tasked with helping homeowners refinance their mortgages will move vertically to become loan officers targeting purchase mortgages.

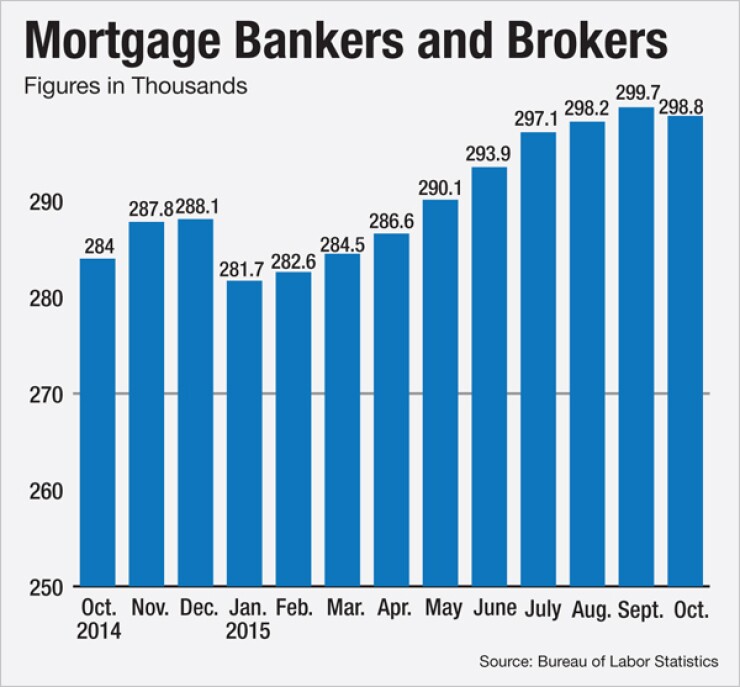

Productivity has slowed because there isn't enough capacity, in terms of personnel, to handle rising volume on the purchase side. As a result, the industry can expect a jump in hiring to expedite the origination process, helping offset the waning job market for refinance personnel, Fratantoni says.

Also, a September survey of mortgage professionals conducted by National Mortgage News found that more than two-thirds of respondents intend to

While underwriters were a critical hire early in 2014 to handle burgeoning volume, Drew Waterhouse, chief executive of recruiting firm HammerHouse, says the focus is now on compliance professionals, given heightened scrutiny from the Consumer Financial Protection Bureau and other regulatory agencies.

Meanwhile, the appraisal industry is one area

"We can't do much about the demographics," says M. Lance Coyle, 2015 president of the Appraisal Institute, but "we can try to change the regulatory environment."

The Appraisal Institute is focusing its efforts next year on easing certification requirements without lowering standards, Coyle says. To appeal to a younger workforce, "there are creative ways, that are efficient, that still produce qualified folks," he adds.

The institute's effort, however, should take a few years to implement and, in the short term, spot shortages of appraisers will become more commonplace. Appraisers are largely viewed as part of a niche industry and, as a result, have not yet garnered the attention needed for sweeping changes.

Rural areas have so far been the most harmed. As shortages become more common, loan officers and mortgage bankers will continue to struggle with closing deals, which will bring more notice to the issue.

"A lot of people are going to pay attention very quickly," Coyle warns. "We're getting there rapidly."

As the appraisal industry scrambles to revitalize its workforce, the outlook for loan officers is slightly better. It's too early to tell if a larger percentage of millennials will be filling more loan officer roles next year, since organizations are only beginning to focus more on programs designed to draw younger employees' interest. Many firms have just begun implementing expedited training.

While a groundswell of millennials in mortgage-related roles is unlikely to occur in 2016, lenders and origination companies are focusing on hiring and properly training greater numbers of younger professionals, says Casey Cunningham, CEO and Founder of professional training firm XINNIX.

Referrals and recruitment to the industry are overwhelmingly coming from friends and family, and other lending officers, according to a nationwide survey XINNIX conducted of new loan officers who had completing the firm's "originator" training program. Over half of new loan officers were recruited by friends and family, while 42% were courted by existing loan officers, presenting a marketing challenge for recruiters.

This challenge is recognized by the National Association of Hispanic Real Estate Professionals,

Motivations for entering the market are shifting, as well as demographics. A change from prior generations, Cunningham says, is what serves as the primary motivator of millennial loan officers who have gone through XINNIX's training program. For those officers, "serving or helping others" is the main motivation, while "income opportunity" and "professional growth" are next in line.

Loan officer compensation will continue to be a sticking point throughout the year, as the CFPB keeps a close eye on the issue.

Will the robots step in and take over for everyone? Unlikely, Fratantoni assures. The only place where that could work is in call centers, which typically have less success in an environment defined by higher purchase volumes. Still, with more self-service origination options at borrowers' fingertips, and lenders like Quicken and Lenda rolling out advanced online options, 2016 is up for grabs for enterprising lenders in the mobile space.

Within the mortgage industry, movements between businesses — away from servicing and refinance and into purchase — are fairly cyclical. A shift in personnel preferences, with a greater emphasis on hiring a younger, more-diverse workforce to mirror shifts in the greater U.S. population, is uncharted territory.

Keeping all that in mind, next year should bear witness to the beginnings of those pieces moving into place, as the industry figures out how to steady itself amid the temblors.