Live Well Financial's creditors are seeking a court-supervised bankruptcy, but the mortgage lender is opposing the move, saying it can get more for certain assets if it sells them before filing.

"Live Well has been working expeditiously with severely limited resources on the liquidation of Live Well's assets outside of bankruptcy such as mortgage loans on its various warehouse lines of credit and mortgage servicing rights because of the severe impairment that a bankruptcy filing would cause to the value of these assets. These sales have been the top priority for Live Well in attempt to preserve value for Live Well's creditors," the mortgage company said in a recent document filed in Delaware's bankruptcy court.

The court filing was a response to a motion by Flagstar Bank, Mirae Asset Securities and the Industrial and Commercial Bank of China Financial Services seeking the appointment of an interim Chapter 7 trustee "to prevent the disposition of assets to the detriment of creditors."

In their motion, the creditors alleged they "learned that Live Well's founder and CEO, Michael C. Hild, has engaged in (and may presently be engaged in) mismanagement of the company and self-dealing to the detriment of Live Well's legitimate creditors."

The creditors also alleged that they each had "been contacted by one or both of the SEC and the FBI regarding Live Well and Mr. Hild, and were cooperating in those entities' investigations, including producing requested documents."

Live Well Financial owes Flagstar more than $68 million related to a secured borrowing, and it respectively owes Mirae Asset Securities and the Industrial and Commercial Bank of China $22 million and $40 million or more related to repurchase agreements, according to the creditors' motion.

But Live Well called the creditors' motion "replete with false statements of fact, material misleading statements of fact and material omissions that must be tested through court-supervised discovery" in the response it filed with the court.

"The alleged debtor looks forward to developing a record for this court in order to rebut the 'upon information and belief' allegations made by the petitioning creditors that Live Well has 'a history of mismanagement and self-dealing by, and for the benefit of, Mr. Hild,'" the company said. "Live Well intends to vigorously contest the claims of wrongdoing and mismanagement."

The Securities and Exchange Commission's enforcement division is conducting an inquiry into Live Well's bond portfolio operations, according to the company. However, Live Well "does not expect that inquiry, which is focused primarily on the period from September 2014 through July 2017, to affect the ability of the company to sell its remaining marketable assets."

Live Well Financial abruptly ceased funding loans and staged layoffs that

The shutdown and layoffs stemmed from financial problems related to an unanticipated change in the market for collateral securing the company's warehouse lines and ensuing regulatory issues, according to a company letter obtained by

"Flagstar learned in April of 2019, that the fair market value of certain bonds serving as collateral for its $70 million line of credit and for which valuations had been consistently provided on a monthly basis since the origination of the loan in March 2017 had sustained a significant and material drop in value," according to the creditors' motion.

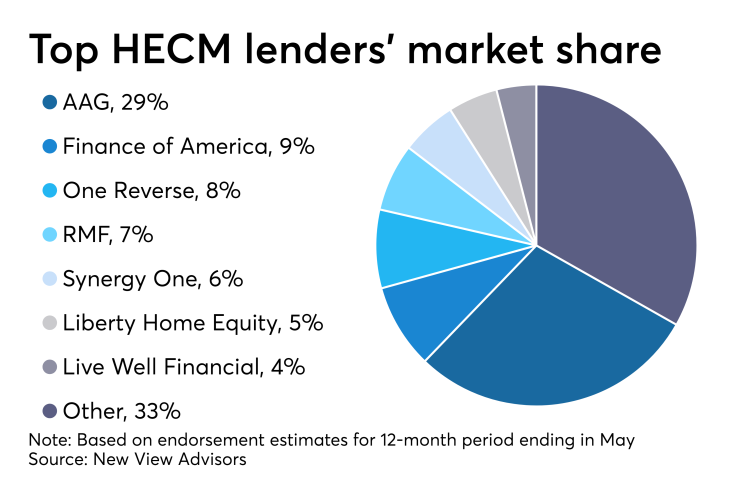

Live Well Financial was the seventh largest originator of government-insured reverse mortgages and had a 4% market share during the 12-month period that ended in May, according to endorsement estimates by consultancy New View Advisors.