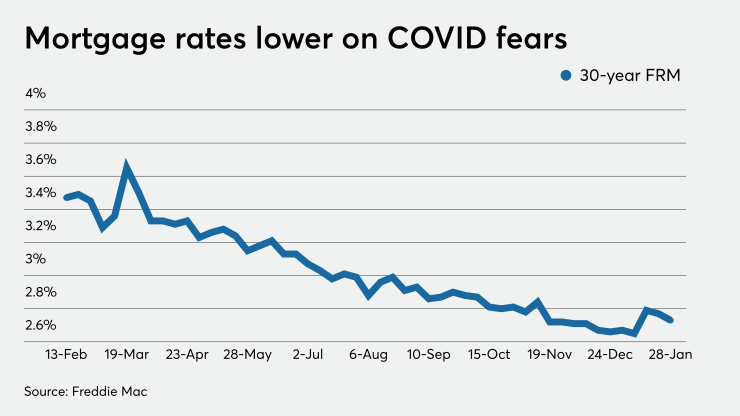

Mortgage rates fell for a second straight week, primarily due to increased anxiety about the pandemic and its effects on the economy, Freddie Mac said.

The 30-year fixed rate mortgage was down by 4 basis points for the week ended Jan. 28, to 2.73%, its Primary Mortgage Market Survey found. That is still above

However, Zillow's rate tracker, which measures mortgage offers made to consumers through its site, did reach a record low last week, Matthew Speakman, an economist for the company, noted in his weekly commentary on Wednesday evening.

"The continued spread of the virus, the introduction of new, more virulent variants, and a thus-far sluggish rollout of the vaccine all injected fresh uncertainty into markets," Speakman said. “Uncertainty surrounding the latest proposed fiscal relief plan also lowered investors' expectations for higher bond yields, and thus mortgage rates.”

Yields for the benchmark 10-year Treasury closed Wednesday night at 1.01%, after touching 1% during the day. This is compared with the Jan. 20 close of 1.09%.

Speakman cited comments issued by Federal Reserve Chairman Jerome Powell following

"All told, this week was yet another reminder that the pandemic continues to call the shots when it comes to mortgage rates and that sustained upward movements are unlikely until it is contained," Speakman said.

The 30-year fixed-rate mortgage averaged 2.73% for the week ending Jan. 21, down

The 15-year fixed-rate mortgage averaged 2.2%, a drop of 1 bp compared with last week when it averaged 2.21%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.8% with an average 0.3 point, unchanged from the previous week. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.24%.