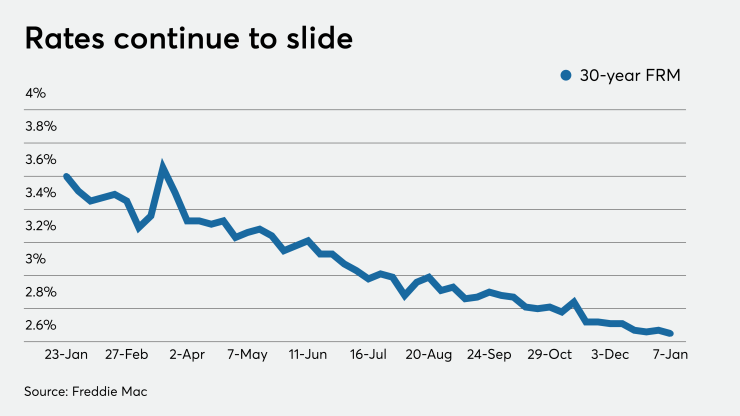

It’s more of the same when it comes to mortgage rates entering 2021, as once again they have dropped to lowest point in the 50-year history of Freddie Mac’s Primary Mortgage Market Survey.

But there are clouds on the horizon that could slow the housing market in the coming months.

“Despite a full percentage point decline in rates over the past year, housing affordability has decreased because these low rates have been offset by rising home prices. However, the forces behind the drop in rates have been shifting over the last few months and rates are poised to rise modestly this year,” Sam Khater, Freddie Mac’s chief economist, said in a press release.

“The combination of rising mortgage rates and increasing home prices will accelerate the decline in affordability and further squeeze potential homebuyers during the spring home sales season.”

The 30-year fixed-rate mortgage averaged 2.65% for the week ending Jan. 7

The 15-year fixed-rate mortgage averaged 2.16%, down slightly from last week when it averaged 2.17%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.07%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.75% with an average 0.3 point, up from last week when it averaged 2.71%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.3%.

Zillow’s own rate tracker increased in the past week, largely in reaction to the Democratic Party’s sweep of the Georgia Senate runoff. The results “came as a surprise to many investors and pushed Treasury yields to their highest levels since the spring,” according to Matthew Speakman, an economist in his weekly commentary issued Wednesday night.

The 10-year Treasury yield, which had been consistently below 1% (with a brief exception) since early March, broke back above that level on Jan. 6, remaining above that mark even with the disturbances at the U.S. Capitol that day.

“The swift increase in rates was a wakeup call, but the path forward for mortgage rates remains uncertain and largely dependent on the economy’s ability to improve. The first test of this will be Friday’s December jobs report, which many expect to show a modest improvement from November,” he continued.

“Should the report fall short of expectations, this upward momentum in bond yields and in mortgage rates could slow, especially if it mirrors the December ADP private payrolls report, which showed a monthly net job loss. More broadly, mortgage rates remain very low by historic standards and should be kept in check by aggressive monetary policy measures which appear unlikely to stop anytime soon.”