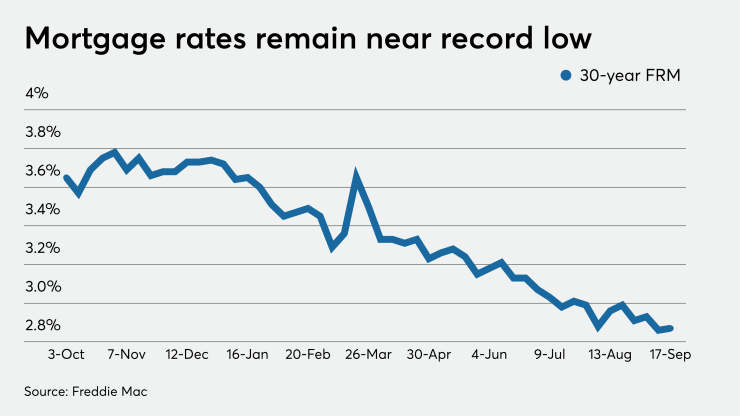

Mortgage rates remained relatively flat, rising a single basis point off of last week's record low, according to Freddie Mac.

Those low rates are bringing potential first-time homeowners into the marketplace, which is having a positive effect on lending activity.

"Despite the recession, the very low mortgage environment has spurred many first-time homebuyers to jump into the real estate market," Sam Khater, Freddie Mac's chief economist, said in a press release. "In August, first-time homebuyer activity rose 19% from July to the highest monthly level ever for Freddie Mac. The first-time homebuyer driven rebound in the housing market has come at a critical time for the economy."

The 30-year fixed-rate mortgage averaged 2.87% for the week ending Sept. 17,

But the 15-year FRM was down 2 basis points from a week ago, averaging 2.35%, compared with 2.37%. A year ago at this time, it averaged 3.21%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.96% with an average 0.3 point, down from last week when it averaged 3.11%. A year ago, it averaged 3.49%.

The adverse impact fee, even though it doesn't go into effect

"A recent wave of borrower demand has extended the turnaround time on loans for many lenders, leading some to apply the price adjustment sooner than they may have previously anticipated," Speakman said. "The Federal Housing Finance Agency director's