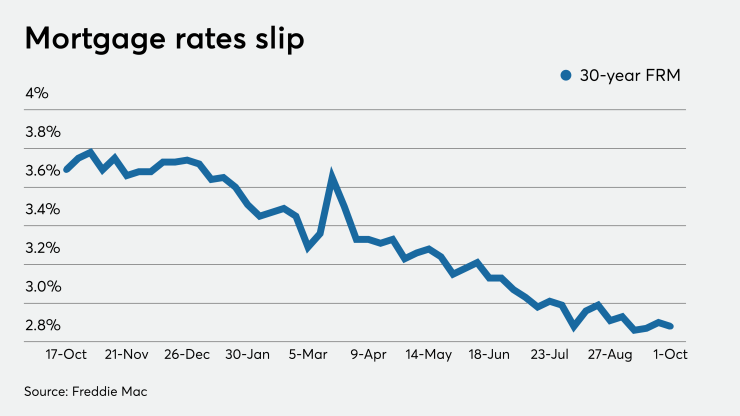

Mortgage rates fell back toward their all-time low this week, increasing purchasing power for homebuyers. But the lack of homes for sale drives up prices and reduces affordability, according to Freddie Mac.

Furthermore, good economic and political news, such as a possible new coronavirus relief bill, could drive rates up.

The 30-year fixed-rate mortgage averaged 2.88% for the week ending Oct. 1,

"As a result of low mortgage rates that have stayed under 3% since July, the housing market has seen a strong, upward trajectory during a very uncertain time," Sam Khater, Freddie Mac's chief economist, said in a press release.

"We're seeing potential homebuyers who now have more purchasing power and many current homeowners who have the option to refinance their loan for a better rate. However, several factors could disrupt this activity including high home prices, low inventory and lender capacity."

The 15-year fixed-rate mortgage averaged 2.36%, down from last week when it averaged 2.4%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.14%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.9% with an average 0.2 point, unchanged from last week. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.38%.

Mortgage rates, which have been in the narrow range over the last several weeks, could start rising again in the near future based on what is happening both in Congress and the U.S. economy, said Matthew Speakman, an economist with Zillow, in a statement following the weekly release of its rate tracker on Wednesday.

"It appears that investors remain confident that near-term volatility in bond markets will remain limited for now," Speakman said. "That outlook was put to the test on Wednesday as surprising and encouraging news regarding a new fiscal relief bill pushed Treasury yields notably upwards for the first time in a while.

"The resulting moves in mortgage rates were minimal, but those dynamics may play out in the coming days. More broadly, the move was a reminder that upward pressure on rates can come at any time. The next test of this may be Friday's September jobs report, which has the potential to surprise markets with good news — or bad," Speakman said.