Mortgage rates rose 20 basis points this week with the Consumer Price Index report coming in stronger than expected, leading to fears that the Federal Reserve is likely to keep raising the federal funds rate for even longer, Freddie Mac said.

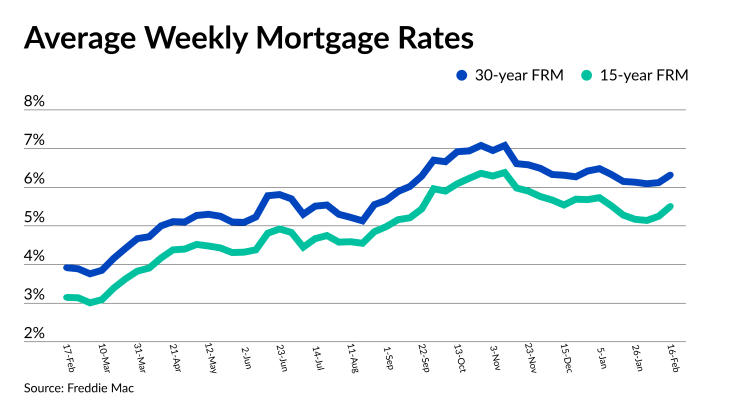

Its Primary Mortgage Market Survey for Feb. 16 averaged 6.32% for the 30-year fixed rate loan, compared with 6.12%

The 15-year fixed rate mortgage had an even larger week-to-week increase. It averaged 5.51%, up 26 basis points from 5.25% for the week of Feb. 9 and from 3.15% one year ago.

"The economy is showing signs of resilience, mainly due to consumer spending, and rates are increasing," said Sam Khater, Freddie Mac chief economist, in a press release. "Overall housing costs are also increasing and therefore impacting inflation, which continues to persist."

The 10-year Treasury yield, which is a benchmark for mortgage prices, was at 3.83% as of noon on Thursday, up 15 basis points from its 3.68% close on Feb. 9. That is the highest the yield has been since Jan. 3.

The market scuttlebutt is that the Federal Open Market Committee is likely to raise rates 50 basis points at its next meeting, especially following comments by Cleveland Fed President Loretta Mester that

At its last meeting, the FOMC raised rates

Christopher Whalen, who writes the Institutional Risk Analyst blog,

"Bottom line: As the FOMC moves short-term rates towards 6%, we expect to take another run at double-digit rates for prime residential mortgage loans," Whalen said. "At some point, the survivors in the world of lending are going to have to start pricing loans to make money rather than defend market share."

Zillow's mortgage rate tracker placed the 30-year FRM at 6.34% on Thursday morning, up 13 basis points from the previous week's average of 6.21%.

It's possible rates are rise in the short term, said Orphe Divounguy, senior macroeconomist at Zillow Home Loans.

"Next week, new data from the Fed's preferred inflation gauge — the PCE Price index — will likely cause more policy uncertainty and higher mortgage rate volatility," Divounguy said.