Mortgage rates

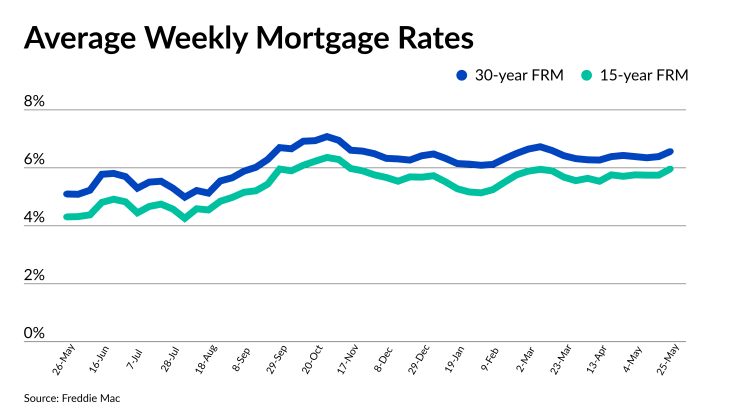

Freddie Mac's Primary Mortgage Market Survey increased 18 basis points to 6.57% as of May 25 from 6.39% the prior week and 5.1%

The 15-year FRM rose 24 basis points on a week-to-week basis to 5.97% from 5.75%. One year ago it was at 4.31%.

"The U.S. economy is showing continued resilience which, combined

Zillow's rate tracker as of Thursday morning for the 30-year FRM was at 6.68%, up from 6.37% one week ago.

The yields on the 10-year Treasury went to 3.78% at 11:30 a.m. on May 25 from 3.65% on May 18 as investors pulled back on fears a deal to raise the debt ceiling won't be reached, said Orphe Divounguy, senior macroeconomist at Zillow Home Loans, in a statement issued Wednesday night.

"The unlikely event of debt default would lead to a credit crisis that could wreak havoc on the financial system and the economy," said Divounguy. "A default is widely expected to result in a large income shock that pushes the U.S. economy in a recession."

Meanwhile, the banking crisis has resulted in credit tightening, while at the same time some Federal Reserve officials are commenting that inflation is still running higher than they would like.

"Mortgage rate volatility will remain elevated as investors pay close attention to the debt ceiling negotiations and this week's inflation reading from the [Personal Consumption Expeditures] price index," said Divounguy.

Freddie Mac has switched to what it termed "a qualitative narrative outlook" for the mortgage market, versus the quantitative version it published quarterly in the past and which is still used on a monthly basis by Fannie Mae and the Mortgage Bankers Association.

Unlike

"On the purchase side, low levels of home sales coupled with falling national house prices will likely keep home purchase originations flat this year," the forecast said. "But, as home price growth turns positive and home sales gradually rise, purchase originations will resume modest growth in the second half of this year and into the next."

Meanwhile refinance volume will remain low as many borrowers are out of the money because of the interest rate environment.

"But as rates ebb and flow, some opportunities will present themselves and a trickle of refinances will flow through," Freddie Mac's forecast said. "There also remains refinance demand for non-rate-related reasons, such as the cancellation of