Mortgage volumes increased last week, with falling rates helping to draw some borrowers to the table, according to the Mortgage Bankers Association.

The Market Composite Index, a weekly measure of mortgage-application activity based on MBA’s survey of members, climbed 5.5% on a seasonally adjusted basis for the weekly period ending Nov. 5. Unadjusted volume rose 5% compared to the previous week, while the seasonally adjusted index came in 21% lower than levels from the same period in 2020.

Both purchases and refinances contributed to the one-week upturn. The Purchase Index increased by 3%, seasonally adjusted, and 0.1%, unadjusted. But the unadjusted purchase volume was 4% below the pace from the same week one year ago. Refinances jumped 7% week over week but were 28% lower from their 2020 level in the same seven-day period.

“Although overall activity remains close to January 2020 lows, homeowners acted on the decrease in rates,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting, in a press release.

Refinances took up a larger share of volume relative to overall activity in comparison to the prior report making it the first percentage increase in six weeks. Refinances accounted for 63.5% of all applications, jumping from 61.9% one week earlier, which was the lowest seven-day share since July. Gains in both conventional and government refinances fueled the uptick, according to Kan.

“Additionally, the average loan balance for a refinance application was the highest in a month,” he said. The mean size of refinances climbed 2.9% to $300,000 from the previous week’s $291,700.

Purchase-application size remained above $400,000 for the seventh consecutive week, up 0.4% at $409,400, from $407,600 seven days earlier. The average size of all mortgage applications also came in higher at $339,900, an uptick of 1.2% from the prior week’s $335,900.

The percentage share of adjustable-rate mortgage applications edged back downward to 3.1% from 3.2% week over week.

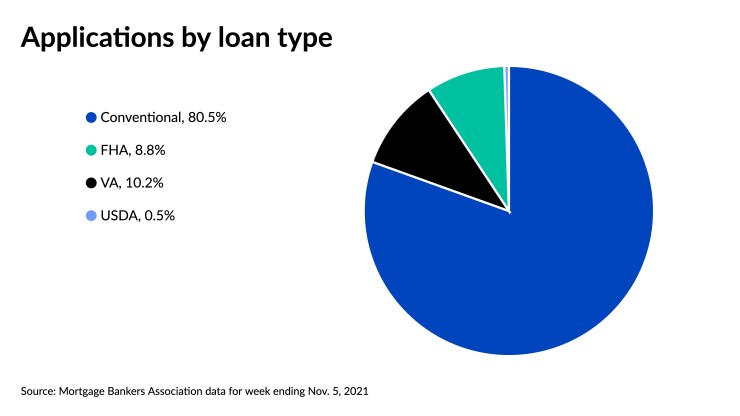

The share of new Federal Housing Administration-backed loan applications decreased to 8.8% from 9.2% the previous week, while Veterans Affairs-sponsored applications increased their share of the week’s activity, rising to 10.2% from 9.9% in the prior reporting period. The percentage of loans taken through U.S. Department of Agriculture programs was unchanged at 0.5% week over week.

Meanwhile, average interest rates declined across the board again last week, according to the survey, helping drive the pace of new activity.

- The average contract interest rate for 30-year fixed-rate mortgages with conforming balances of $548,250 or less dropped to 3.16% from 3.24% a week ago. The 30-year conforming rate has fallen 14 basis points over two weeks.

- The 30-year jumbo fixed-rate mortgage for balances greater than $548,250 fell three basis points to 3.26% from 3.29% week over week.

- The 30-year fixed-rate average for loans backed by the FHA dropped 11 basis points to 3.18% from 3.29% the prior week.

- The 15-year fixed-rate mortgage average declined for the second week in a row, coming in at 2.52% after posting an average of 2.58% a week earlier.

- The 5/1 adjustable-rate average also dropped six basis points compared to the previous seven-day reporting period, to 2.82% from 2.88%.