After

The MBA’s Market Composite Index, a measure of weekly loan activity based on surveys of association members, dropped a seasonally adjusted 11% for the period ending May 13, as purchases and refinances both slowed. When compared to the same time period in 2021, last week’s volume came in 56% lower.

The latest weekly numbers come as the MBA adjusted

The seasonally adjusted Purchase Index fell 12% from one week earlier, with volumes also down 15% from a year ago, even as elevated mortgage rates declined. Potential homebuyers have been put off by the recent surge in interest rates as well as

“Furthermore, general uncertainty about the near-term economic outlook, as well as recent stock market volatility, may be causing some households to delay their home search,” Kan said in a press release.

The Refinance Index also tumbled 10% from seven days earlier, dropping for the ninth time out of the last 10 weeks, as “the current level of rates continues to be a significant disincentive” for refinancing, Kan said. The latest volumes are currently 76% below activity seen during the same weekly period last year.

But despite dropping, refinance volume relative to total loan activity ticked upward compared to the prior week, accounting for 33% of all applications, up from 32.4%. Meanwhile,

New loans fell in average size across all categories after expanding a week earlier. The mean purchase size fell 1.9% to $441,100 from $449,800, while the average refinance amount decreased to $283,000, 6.3% lower than the prior week’s $302,000. The average size of all applications came out to $388,900, 3.2% below $401,900 seven days earlier.

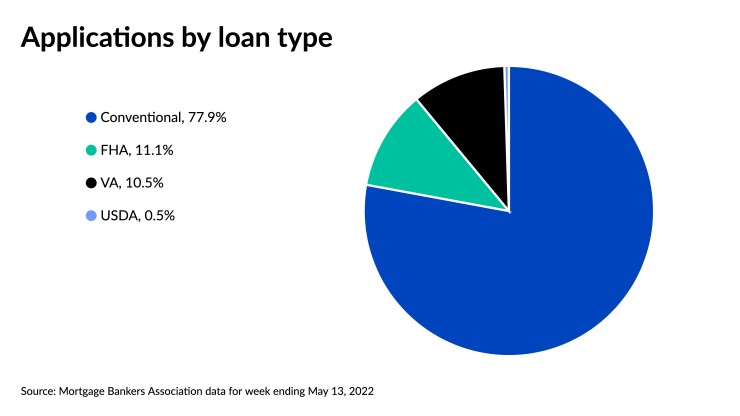

Federally backed loans accounted for a larger share of total volume, as

Contract interest rates among MBA members all dropped on average week over week, seven days after the 30-year conforming mortgage hit its highest mark since 2009 of 5.53%. The contract average of 30-year mortgages with balances conforming to the Fannie Mae and Freddie Mac loan limit of $647,200 slid last week by 4 basis points to 5.49%.

The average contract rate for 30-year jumbo loans with balances exceeding the conforming threshold also dropped to 5.03% from 5.08% a week earlier.

The FHA-backed 30-year mortgage contract interest rate averaged 5.32%, a similar weekly decrease of 5 basis points from 5.37%.

Both 15-year and adjustable-rate averages also took a step back after recent upswings. The contract rate average of the 15-year fixed mortgage dropped 6 basis points to 4.73% from 4.79% the previous week, while 5/1 ARMs decreased to 4.42% from 4.47%.