Mortgage bankers only made 5 basis points on each loan originated in the first quarter, preliminary data from the Mortgage Bankers Association showed, as the cost to produce reached an all-time high.

The situation is "very, very challenging and very similar to what we saw in 2018," Mortgage Bankers Association Chief Economist Mike Fratantoni said during the group's Secondary and Capital Markets Conference on May 16. "This is coming both from a reduction in revenue as pricing gets a little bit tighter, and we're seeing — at least on dollar per loan basis — we're at an all-time high in terms of costs to originate at about $10,600 per loan."

In the fourth quarter of last year, mortgage bankers earned 38 bps per loan.

In both the first and fourth quarters of 2018, mortgage bankers were

The full data set is expected to be released shortly.

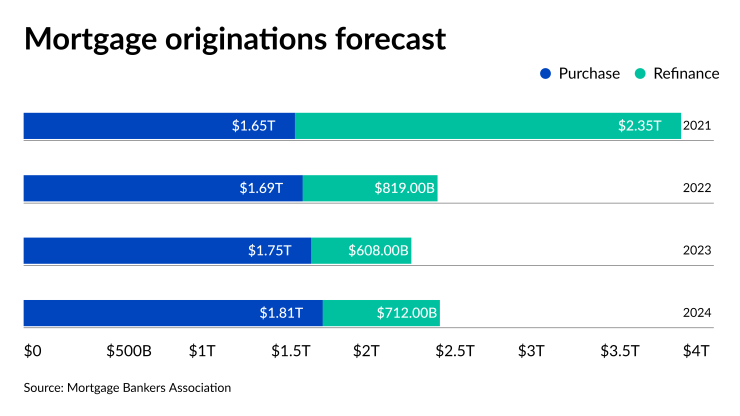

Fratantoni's latest origination forecast is for $2.51 trillion in production this year, a slight tightening compared with

While still calling for a record high in purchase originations this year, Fratantoni cut the forecast to $1.69 trillion from $1.72 trillion. Refinance volume is now expected to come in at $819 billion, compared with the prior prediction of $841 billion.

The outlook for the next two years has also been revised downward to $2.36 trillion of total volume in 2023 and $2.53 trillion in 2024. But purchase will continue to grow, to $1.75 trillion and $1.81 trillion respectively.

Lenders should "expect that the strong fundamentals from the job market and demographics are going to continue to keep housing demand very robust," Fratantoni continued.

When it comes to spreads, the market is seeing some "dislocation" now. The spread between the primary rate and secondary rate is a function of capacity and competition, and right now, it is the tightest in 10 years, he said.

But the spread between mortgage-backed securities current coupon yield and the 10-year Treasury is as wide as it was during some crisis periods, indicating concern not just about the Federal Reserve's balance sheet, but its overall policy, he said.

Meanwhile

But for most of the last few years, jumbos have been cheaper and right now, they are being priced 45 bps lower, a record gap.

"The question that it brings to my mind is what does this say about the way banks are valuing the mortgage assets compared to the way capital markets are valuing that same asset," Fratantoni said. "And the difference really may well reflect this policy uncertainty that we're talking about because obviously the bank holding a whole loan is not going to be impacted, at least directly, by what the Fed's doing with their balance sheet."

Banks typically portfolio jumbo loans as part of a relationship strategy.

While some economists have been predicting that the U.S. is heading for a

His response to those asking why not? "The market is not the economy. The economy is not the market." Consumer spending is geared primarily to services, but the stock market heavily leans towards goods.

"And so since goods are getting hammered more than others, it makes sense that even though we are not forecasting a recession as our baseline outlook … it's unsurprising then once you start from that premise that the stock market might underperform the economy as a whole," Carpenter said.

Still, a "bumpy landing" for the U.S. economy is more likely than a soft one.

"They've got a real shot at avoiding an outright recession because they are very aware that they're tightening in order to slow down the economy; they want to slow it down a lot, but not too much," Carpenter said. "And Chair Powell's consistent use of the word nimble I think underscores their willingness to react if they see it going too far."