More than half of recent, as well as prospective,

Only 41% of the prospective buyers said they felt very well prepared for the house buying process, while 57% worried they couldn't afford homeownership.

Slightly less than half, 47%, perceived the process as being "rigged" against the buyer.

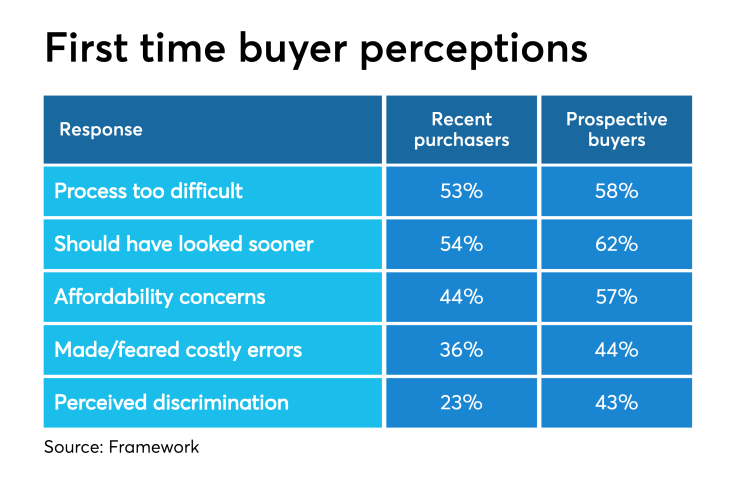

The survey also found that 43% of prospective buyers and 23% of recent purchasers said they experienced discrimination based on their race, gender or other trait.

The numbers were higher for Hispanic (41%) and African-American first-time buyers (34%), Framework said.

While many first-time buyers expressed feelings of anxiety prior to entering the home purchase market, it receded slightly once they settled in to their new home — confirming other studies that find ownership has

Worry about affording homeownership was 13 percentage points lower for recent first-time buyers than prospective buyers (44% vs. 57% respectively).

And only 36% of recent first-time buyers think they made costly mistakes during the process compared with the 44% of prospective buyers that feared doing so.

The majority, 55%, said they want "an independent advocate" to coach them not only through the buying process, but also for the details around owning a home.

But given the ongoing economic uncertainty, which caused shifts in the

Among those that already purchased a property, 64% of the respondents to the Framework survey said they emerged from the process knowing a lot more about the financial implications of homeownership than before they entered it. Just three in 10 recent first-time buyers took home buying or homeownership classes prior to their purchase.

Framework commissioned two surveys that were given between Sept. 6 and Sept. 11.

The first group consisted of 334 people that who purchased their first home in the past three years. The second survey was of 348 people that said they are looking to purchase their first home in the next 12 months.

Brodeur Partners conducted the surveys on FrameWork's behalf.