Approximately two-thirds of millennial and Generation-Z renters expect to purchase a home in the next five years, although their aspirations for homeownership slipped from a year ago, a Pulsenomics survey found.

"Moderating home price growth, falling mortgage rates and solid wage gains in the first quarter have stoked housing expectations and homeownership aspirations" for all groups, said Pulsenomics founder Terry Loebs in a press release.

However, the

"Although our research confirms significant variation in housing confidence and transaction sentiments by market and household category, overall, these latest index data point to an improving balance of power between real estate buyers and sellers," Loebs said.

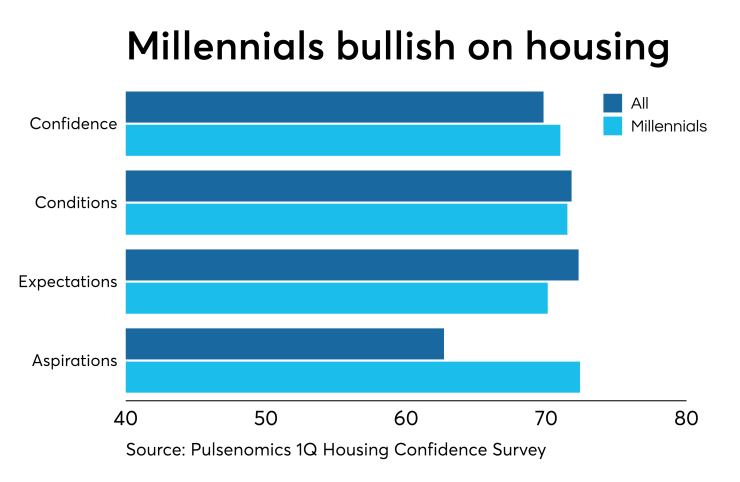

The Housing Confidence Survey index for all generations was 69.8 in the first quarter, but for

Millennials have a higher homeownership aspirations index than the general population, 72.4 versus 62.7, respectively. But the index is down from 72.9 for the first quarter one year ago and 73.1 from the third quarter.

For the general population, the index rose from 61.3 in the first quarter of 2018 and 61.9 in the third quarter.

Housing confidence among prospective

For both the total sample and millennials, 59% said it was a good time to buy. On the other hand 14% of all respondents and 17% of millennials considered it a bad time.

Among millennials, affordability was considered by 26% as the most important reason to buy, while 25% said home values will continue to rise. Lots of homes for sale to choose from was cited by 14%, while

For the entire sample, affordability was cited by 24%, rising values by 23% and mortgage rates by 17%.

At the same time, 58% of those surveyed said now is a good time to sell a home.

The changes to the home interest deduction because of

"At an average rate of more than 6%, household expectations for home prices over the next 12 months are remarkably high," said economist and Pulsenomics adviser Robert Shiller (one of the namesakes of the Case-Shiller Index). "But the expectations over the next 10 years — at 2.7% a year nationwide — are entirely tame and reasonable, just a little over the 2% target inflation rate set by the Federal Reserve. I would say that households nationwide are showing here a healthy optimism, but none of the extreme expectations seen in the run-up to the 2008-2009 financial crisis."