The Mortgage Bankers Association again

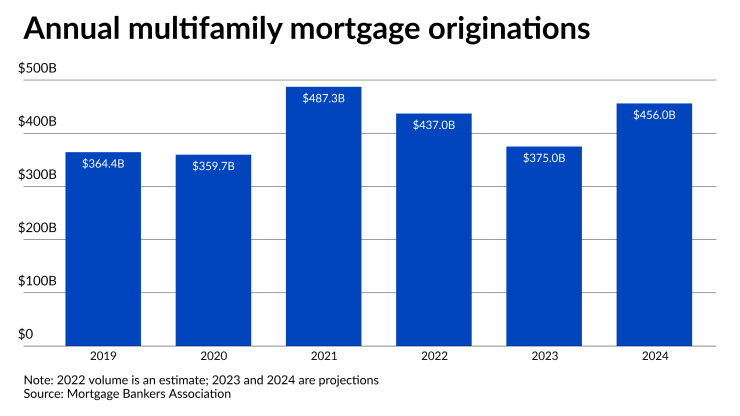

Multifamily mortgage originations are now projected to total $375 billion, approximately $9 billion lower than its last forecast, which was released in February. This would be a 14% year-over-year drop from the latest estimates for 2022 volume of $437 billion. The data from last year's volume is an update from a previous estimate of $459 billion.

The February outlook was a $9 billion reduction

Total commercial lending is now expected to end 2023 at $654 billion, a 20% decline from $816 billion a year ago. That is $30 billion less than the February outlook of $684 billion.

"Higher interest rates, uncertainty about property values, and questions about the outlook for the cash flows of some properties led to a slowdown in commercial real estate transactions and financing beginning in the middle of 2022," said Jamie Woodwell, head of commercial real estate research, in a press release. "That slowdown is likely to persist through much of this year as investors, lenders, and others look for greater transparency into the markets."

In the light of the recent failures of Silicon Valley Bank, Signature Bank and First Republic Bank,

Multifamily originations

"We expect maturing loans to begin to break the logjam and provide greater clarity as this year goes on," Woodwell said. "However, it may take until 2025 for volumes to get back to previous years' levels."

For 2024, the MBA expects the multifamily market to grow to $456 billion. That is a $30 billion reduction from its February forecast of $486 billion.

Total commercial mortgage lending should reach $829 billion next year, the trade group said.