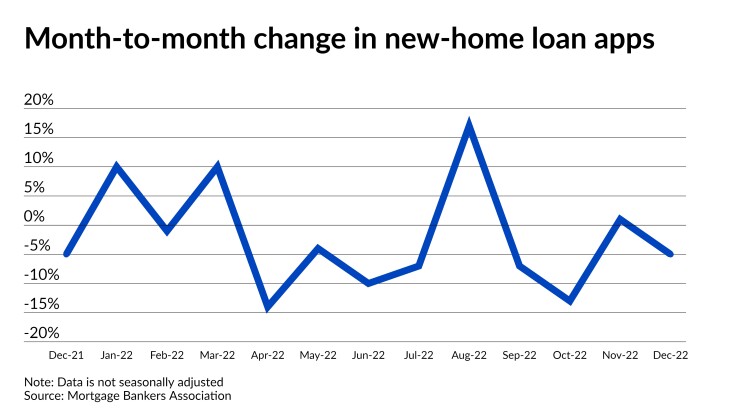

Mortgage applications to purchase a newly constructed home renewed their month-to-month decline in December,

Compared

"The decline in activity was in line with single-family housing starts that were 32% lower than a year ago," Joel Kan, the MBA's deputy chief economist, said in a press release. "Higher mortgage rates and a weakening economy held back buyers at the end of last year."

The average loan size sought to buy a new home increased approximately 1.8% to $399,555 in December from $392,465 in November. Conventional loans composed 69.1% of mortgages sought, followed by Federal Housing Administration at 20%, Veterans Affairs making up10.5% of the total and the remaining 0.3% were seeking a U.S. Department of Agriculture/Rural Housing Service product.

"In the new-home market, builder incentives such as price cuts, paying points and providing mortgage rate buy-downs are being used to bolster sales," First American Financial Deputy Chief Economist Odeta Kushi said in a commentary on

The MBA estimated that new single-family home sales were running at a seasonally adjusted annual rate of 641,000 units in December, a decrease of 2.9% from November's 660,000 units. On an unadjusted basis, the MBA approximated 45,000 new home sales during December, down 8.2% from 49,000 new home sales in November.

But Kan was mildly positive about the future of new home sales activity, pointing to a January increase in the National Association of Home Builders/Wells Fargo Housing Market Index, the first month-to-month increase since December 2021, which he attributed

But the rise to 35 from

"The housing market is still in need of more starter and entry-level homes, especially when current demographic trends point to the potential for more younger households to enter homeownership in the near future," Kan said "New construction of these units will help these buyers entering the housing market."

And with mortgage rates continuing to moderate and the traditional spring home purchase season approaching, "it's possible that the worst of the impact to sales is behind us," First American's Kushi said.