February's volume of mortgage loan applications for newly constructed homes rose both year-over-year and month-to-month, continuing the momentum from a surprisingly strong showing in January.

New home applications increased by 3% compared with January and by 4.6% compared with February 2017, according to the Mortgage Bankers Association. The data is not seasonally adjusted.

"Brisk activity in January likely pulled forward some buyer activity," Lynn Fisher, the MBA's vice president of research and economics, said in a press release.

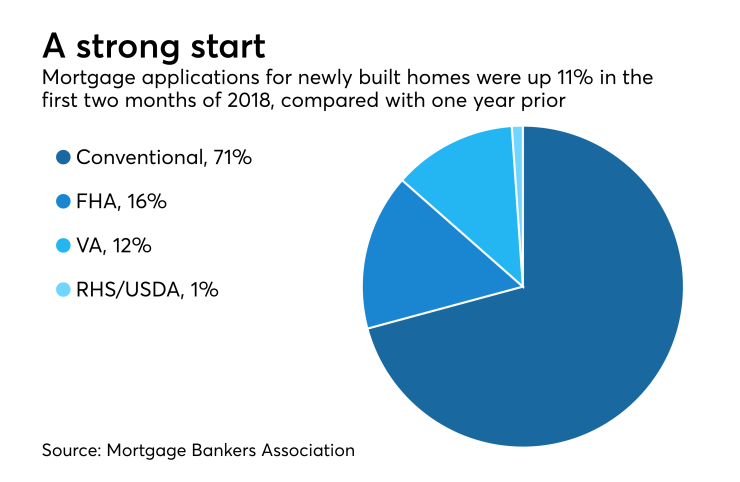

"Combined, applications in January and February were up by 11% relative the same period last year. On a seasonally adjusted annual basis, our February estimate of new home sales based on mortgage applications came in at 632,000, ahead of the January Census estimate of 593,000 new homes sales, and back on trend following an uptick from hurricane-related rebuilding."

The Builder Application Survey for January reported a 34% increase in volume

By product type, conventional loans composed 70.8% of loan applications, while Federal Housing Administration-insured loans had a 15.7% share, the Veterans Administration guarantee program had a 12.4% share and the Rural Housing Service/U.S. Department of Agriculture made up 1.1% of the volume. The average loan size of new homes decreased from $338,918 in January to $338,078 in February.

February's seasonally adjusted estimate was a decrease of 9.7% from the January pace of 700,000 units. On an unadjusted basis, the MBA estimates that there were 55,000 new home sales in February 2018, an increase of 1.9% from 54,000 new home sales in January.

Homebuilders, through joint ventures with mortgage lenders, have been moving more into this space. William Lyon Homes recently