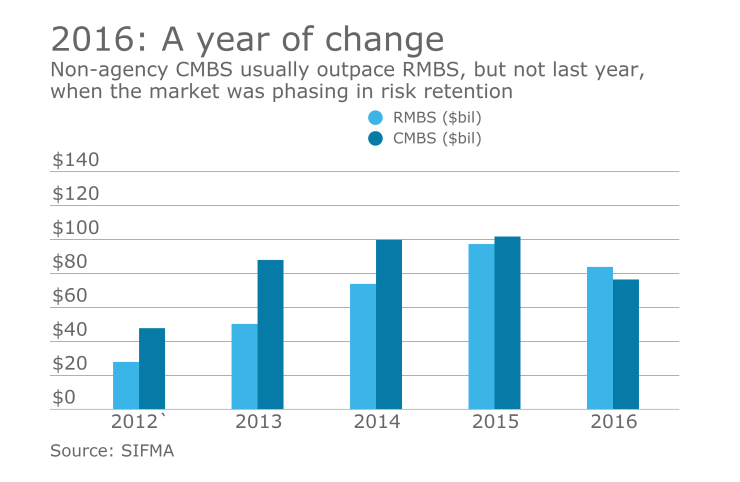

Agency mortgage-backed securities issuance increased in 2016, rising to $1.6 trillion from $1.3 trillion, while nonagency mortgage securitization issuance decreased.

Nonagency RMBS issuance fell 13.6% to $84.2 billion in 2016, the first full year in which risk retention rules for that part of the market were in effect. Risk retention rules went

Some issuers of bonds backed by jumbo loans made to prime credit borrowers were less active during the year but there was at least one new entrant, marketplace lender Social Finance.

Commercial MBS issuance outside the agency market fell 24.9% to $76.5 billion during the course of 2016, a year in which large-loan CMBS deals "almost vanished entirely." Risk retention went