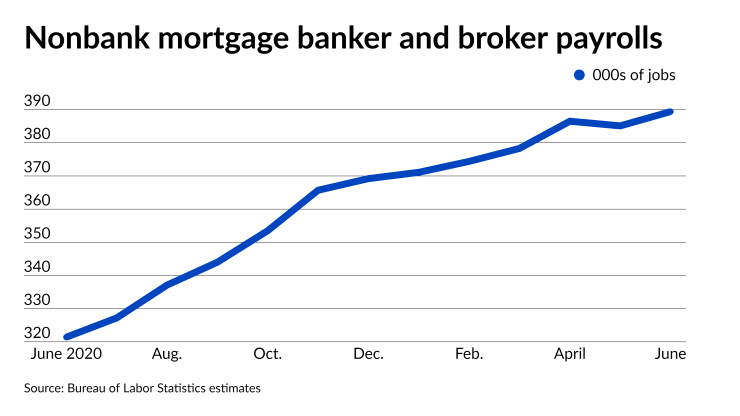

Payrolls at non-depository housing finance companies inched up in June after a slight dip the previous month, according to the Bureau of Labor Statistics’ latest job estimates.

The number of mortgage bankers and brokers employed by nonbanks rose to 389,400 from a downwardly revised 385,100

The slight gain reinforces

“As we start to see default volumes start to ramp up, it will be a question of how quickly servicers can match the need for this excess capacity,” said Mike Rawls, CEO of Xome, a Mr. Cooper affiliate, in an interview.

Some servicers and outsourcers have been

The still-booming housing market could also lead to some hiring in loan production with possible increases in inventory that’s been tight coming from the resumption of loan workouts, but the outlook for that varies widely by region.

The ban’s end and the rate at which distressed borrowers cut deals to satisfy their debt by selling properties are reportedly spurring inventory gains in Florida, which has a relatively fast foreclosure process and relatively few restrictions. However, the pandemic remains a risk to the pace of home sales in all markets with vaccination rates varying and infection rates going up.

“I’ve personally seen a little bit of softening in terms of selection for our buyers...but the concern is...these COVID numbers,” said Kristen Conti, broker-owner of Peacock Premier Properties in Englewood, Fla., during a virtual panel discussion organized by distressed asset specialist Gryphon USA on Thursday. Conti is a board member for industry networking group Default Industry Leaders.

Much depends also on whether consumer demand and incomes are strong enough to sustain what in many places are still sky-high home prices driven by the tightness in inventory, something broader job recovery in the numbers released Friday supported.

The U.S. economy added 943,000 jobs in July, which marked the fastest pace seen in nearly a year, although it’s worth noting that the total was only slightly higher than an upwardly revised 938,000 figure for June and some of the gain may have stemmed from the end of enhanced unemployment benefits in some states. (Broader jobs numbers are released with less of a lag than nonbank mortgage industry estimates.)

A drop in the unemployment rate to 5.4% in July from 5.9% the previous month was another positive indicator for consumer spending. However, those numbers might actually be slightly higher due to an ongoing BLS misclassification error. Unemployment also remains elevated compared to historically low pre-pandemic levels just below 4%.

“Nearly 75% of the jobs lost at the start of the pandemic have been recouped. At this monthly pace, we would return to the pre-COVID employment peak by February 2022,” First American Deputy Chief Economist Odeta Kushi said in an emailed statement.