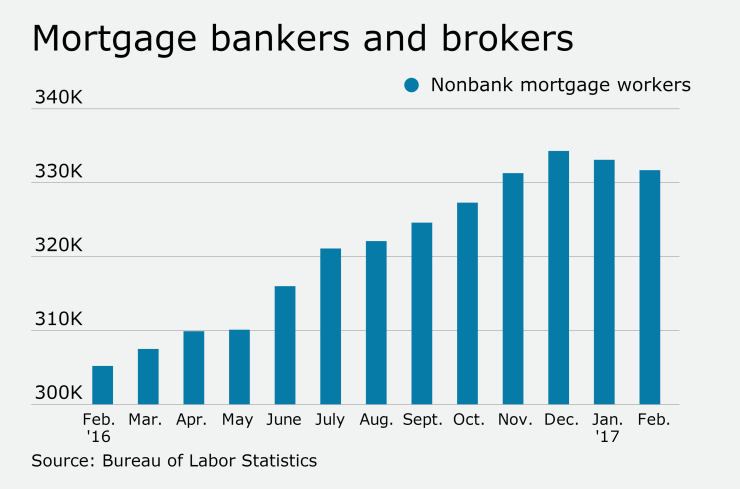

Employment in the nondepository mortgage banker and broker sector fell for the second consecutive month in February.

Nonbank mortgage companies cut 1,400 jobs in February, bringing total employment in the sector to 331,700, the Bureau of Labor of Statistics reported Friday. The original BLS estimate for January was also revised slightly downward, bringing the total number of jobs cut to 3,000 this year.

The decline in mortgage sector employment follows in the tracks of the Federal Reserve's Dec. 15 interest rate hike, which was followed by

While nonbanks' shrinking headcounts may indicate growing concerns over demand for mortgages and rising interest rates, it's common for employment levels to dip early in the year. Mortgage bankers and brokers cut 2,600 jobs during the first two months of 2016 before a 10-month hiring surge added

Still, the share of lenders that expect demand for purchase mortgages to grow over the next three months fell to the lowest level ever recorded for a first-quarter edition of Fannie Mae's lender sentiment survey, which began in 2014.

For refinance mortgages, "the demand growth expectations across all loan types rose slightly from the prior quarter, which had registered the survey's worst performance," Fannie Mae said.

Meanwhile, analysts are still waiting for the millennial generation to pump some life into the housing market. But the news is not encouraging, as 38% of millennials have subprime credit, TransUnion said in a report this week. Nearly half (42%) of millennials claim they are delaying buying a home because of the Dec. 15 interest rate hike, the credit reporting agency added.

"Housing demand is being held back by long-running demographic influences, tight credit conditions and a host of supply constraints," economists at Wells Fargo Securities said in a report this week.

Industry-specific BLS estimates lag one month behind its national data. Overall, the U.S. economy created 98,000 jobs in March, down from 216,000 in the prior month, the BLS reported Friday. The February jobs number was revised downward by 22,000. The U.S. unemployment rate fell to 4.5% in March, down from 4.7% in February.