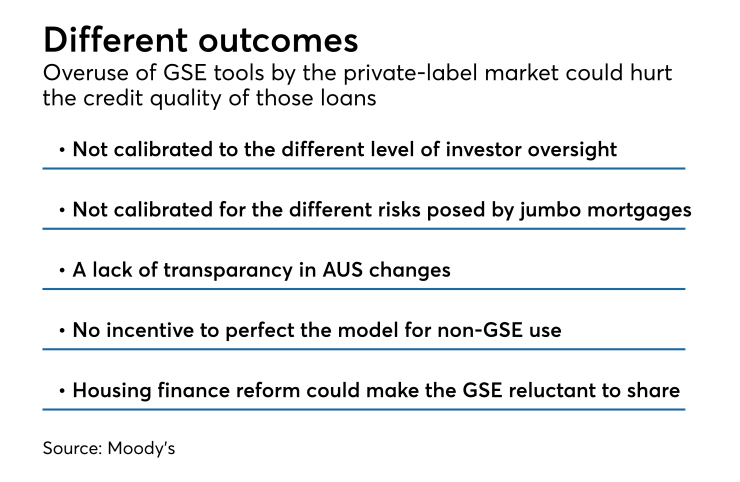

Being too dependent on the automated underwriting tools created by the government-sponsored enterprises to originate loans underlying private-label mortgage-backed securitizations could negatively affect their credit quality, a report from Moody's said.

The dominant role that Fannie Mae and Freddie Mac have in the mortgage market gives them resources that can provide benefits to the private-label market, such as using the large amounts of high-quality proprietary data in the GSEs' automated underwriting and appraisal risk assessment systems. That information is increasingly being used on loans packaged into private-label securitizations.

"Despite these potential benefits, the GSEs' activities and tools can introduce risks for both individual private-label transactions and credit quality in the PLS market over the longer term if market participants fail to use them judiciously," Lima Ekram, Moody's assistant vice president, said in a press release.

Among the particular areas that need to be monitored are risk assessments and due diligence for newly originated loans, where the use of these tools is on the rise.

The inclusion of agency-eligible paper in private-label securities is on the rise, as lenders seek

But using LP and DU adds risk, "partly because the GSEs' standards are calibrated to mortgages that they will remain involved with, which benefit from their ongoing monitoring and oversight of servicers and greater ability to demand repurchases by originators of faulty loans," the Moody's report said.

Furthermore, LP and DU are set up to measure risk factors for conforming loans, and not the

Plus, both Fannie Mae and Freddie Mac's automated underwriting systems "lack complete transparency, which exposes market participants to potentially failing to appreciate when changes to the underwriting engines have a greater effect on specific market segments, such as certain loan products or borrowers with specific characteristics," Moody's said.

The overhang of

"At some point Fannie Mae and Freddie Mac may no longer be large enough to play the same role in the mortgage market or even exist," the report said. "If not under conservatorships, they may also become less generous with allowing the use of their tools by competitors, or not devote similar resources to improving their tools and processes. Increased discussion around the GSE reform among policymakers increases the importance of considering these possibilities."