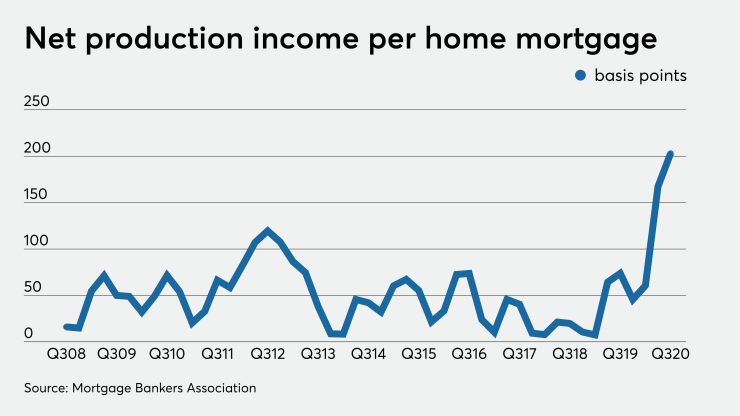

The money lenders make on each home loan hit another survey-record high in the third quarter despite increased expenses that put downward pressure on margins, according to the Mortgage Bankers Association.

The average pretax production profit for independent mortgage companies and home-loan subsidiaries of chartered banks was 203 basis points of the principal balance on each unit originated during the period. That translates to net income of $5,535 per loan.

In comparison, there were 73.8 basis points of profit or $1,924 of net income on each mortgage originated in

Per-loan expenses in the third quarter of this year were $7,452 on average, compared to $7,217 during the same period last year and $6,566 in the second quarter of 2020.

Despite the economies of scale that accompany high volumes, costs are up because mortgage companies are paying a lot to bring in enough new hires to keep up with the stream of loans pouring in.

“Production expenses usually drop with increased volume, as fixed costs are spread over more loans. But in the third quarter, costs rose despite the volume increase. One major reason for this increase was escalating personnel costs,” Marina Walsh, the MBA’s vice president of industry analysis, said in a press release.

While rising costs may not hurt mortgage companies immediately, since they’re being more than offset by revenues from heavy rate-driven refinancing, there’s a general expectation in the industry that the longer a refi boom goes on, the more risk of downward pressure on margins there will be.

“It’s the normal cycle that you expect to see in the industry when there are these big refi waves,” said Nathan Lee, a partner at industry consultancy Richey May. “When the refi boom gets long in the tooth, rates start to move back up and the refis start to slow down even a little bit, then mortgage companies start to compete with each other. They say, ‘We’re going to squeeze our margin and we’re going to reduce our pricing so that we can keep volume coming in.’”

Margins could also shrink due to

“Rates are going to rise, there is going to be some consolidation in the mortgage business and it’s going to create more price competition, so your margins will compress slightly,” David Stevens, a former executive director of the MBA and CEO of Mountain Lake Consulting, said during a virtual event hosted by the Empire State Mortgage Bankers Association on Wednesday.

While overall volume may be lower next year, the mortgage market is likely to remain historically strong thanks to extraordinary demand for homes and a relatively shortage of supply that is expected to drive purchase volumes

The number of owner households has seen large year-over-year gains in recent years, according to a

“I’m telling you, this is a no-lose game,” said Stevens. “We haven’t seen this type of demographic vantage point since the baby boom generation began their peak buying years in the early 1980s. I’m in the biggest cohort of the baby boom generation. We drove the housing market for three decades, and that’s what this millennial generation is going to do for all of you.”