Wholesale and correspondent lender Plaza Home Mortgage has improved its pricing for certain jumbo loans that Fannie Mae's automated underwriting system approves, but categorizes as ineligible due to loan size.

"It's a nonagency product, but it's priced closer to an agency product than a typical jumbo," Plaza Chairman, President and CEO Kevin Parra said in a recent interview.

AU system conditions attached to the single-family loans by Fannie Mae's Desktop Underwriter must be fulfilled in lieu of the more complex underwriting steps typically required for jumbo loans, he said.

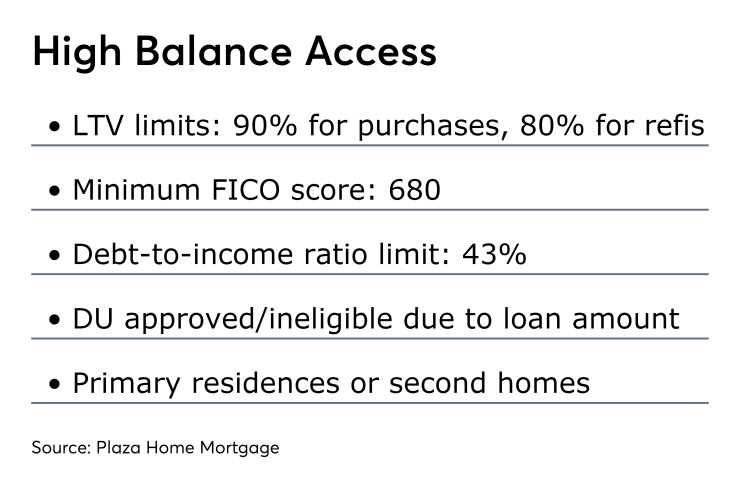

The mortgages submitted to the new High Balance Access program can be secured by primary residences or second homes. The maximum loan-to-value ratio is 90% for purchases and 80% for refinances. The minimum FICO score is 680 and the maximum debt-to-income ratio is 43%.

The loans typically fall within the government-sponsored enterprise limits found in certain higher-cost areas such as the East and West Coasts, but are secured by properties in areas of the country where limits are lower, such as the Midwest.

The maximum GSE loan limit is generally $484,350. But for a very limited number of areas in which 115% of the local median home value exceeds that limit, the maximum is higher. Loans on one-unit properties in most of these higher-cost counties have a $726,525 limit that is 150% of the baseline loan limit.

Other mortgages Plaza added to its line-up recently include a