Quontic, a New York-based Community Development Financial Institution, rolled out a streamlined non-qualified mortgage refinance product that will not require the borrower to provide verifications or documentation.

Processing Content

"The Dodd-Frank regulations have placed an unnecessary financial burden on non-QM mortgage customers as they typically obtain mortgages at interest rates of anywhere between 1% to 4% higher than conventional mortgage customers," Quontic CEO Steve Schnall said in a press release. "Many are paying upwards of 7% even with today's average rate of 3.78%. The mission of our bank is to serve the underbanked and our Streamline Refinance is a powerful tool to reduce interest rates and mortgage payments for existing homeowners who are paying an excessive rate despite a solid payment history."

"Quontic is one of less than 2% of CDFI banks in the U.S and we were able to earn this status because approximately 70% of our home loans are to low-income populations. Quontic is proud to make homeownership even more affordable for the most financially vulnerable homeowners in our society."

This loan, Quontic said, rewards borrowers who pay higher interest rates because of income documentation issues.

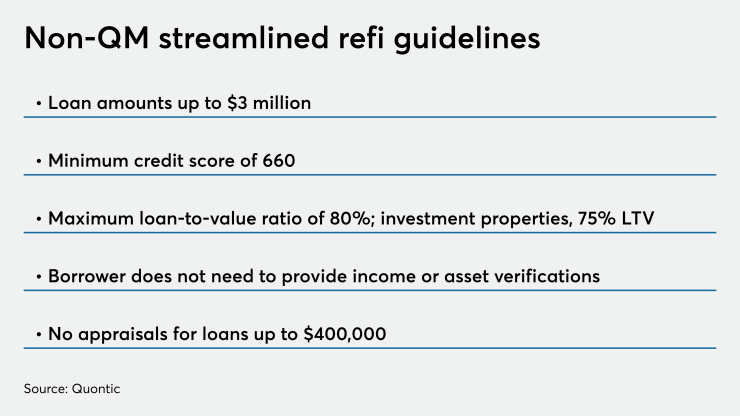

Quontic is willing to lend up to $3 million for borrowers whose credit score is over 660 and made 24 timely payments on their current mortgage at an 80% loan-to-value ratio. The borrower will not have to verify income or assets, provide tax returns, W-2s, bank statements or any other documentation traditionally used to qualify for a mortgage.

Appraisals will not be required for loans up to $400,000. Investment properties are eligible at LTVs up to 75%.

The product is available nationwide. Closings should take less than 30 days from application, Quontic said. Standard closing costs apply but can be rolled into the mortgage.

One of the factors that lead to the housing crisis of the mid-2000s was the use of no verification and light verification mortgage products for broader markets than they were intended for.

But versions of these products with tighter underwriting requirements have returned to the market.

In 2016, Quontic came out with its "Lite Doc" product, also aimed at borrowers that had problems documenting income in a conventional fashion. That loan, for the borrower's primary residence, had a 60% LTV limit and a 700 credit score requirement, Schnall said at the time.

Last April, 360 Mortgage of Austin, Texas, came out with a no-income, no-asset verification mortgage for non-owner-occupied properties underwritten to guidelines based on Fannie Mae's.