Rising interest rates made mortgage lenders bearish on their short-term outlook for purchase originations and that is affecting their expectations on profits, according to Fannie Mae.

Even as the mortgage lenders who believe the economy is heading in the right direction reached a new high, expectations for purchase originations in the next three months hit their lowest level since Fannie Mae started doing its Lender Sentiment Survey in the first quarter of 2014.

Across all loan types, conforming, government and nonconforming, lenders blamed increased interest rates for the poor outlook. For government loans, a lack of inventory is the second most cited factor for the poor outlook, while for conforming loans rising prices ranked No. 2. For nonconforming loans, the second most named reason was the difficulty of qualifying for a mortgage.

"This quarter, lenders' optimism toward the overall economy and home price appreciation hit survey highs," said Doug Duncan, senior vice president and chief economist at Fannie Mae, in a press release.

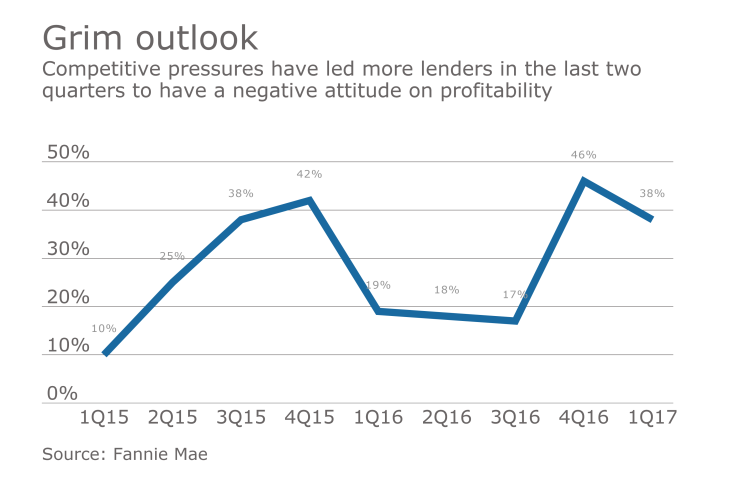

"However, lenders' profit margin outlook remains significantly less positive than this time last year and two years ago. Lenders cite competition from other lenders and a market shift from refinance to purchase — both of which reached survey highs — as the top reasons for the weak profit margin outlook," he added.

Approximately 38% of lenders expected their profits to decline, which is an improvement from the fourth quarter's 46%. However in the first quarter of 2016, only 19% said they expected their profitability to worsen.

Competition was cited by two-thirds of those surveyed as a reason for the decline in profits, while the shift to the purchase market — which has higher margins but also higher expenses — was cited by 51%. Government regulation was next, named by 21% of lenders.

Ironically, for the 16% who expected their profits to increase, the shift to the purchase market was cited by 33%, following operational efficiency at 55% and consumer demand at 44%.

"We expect refinance activity will fall and purchase affordability will tighten, increasing competitive pressure in a shrinking mortgage market. Lenders may choose to adjust their production capabilities and staff resources given their profitability outlook," Duncan said.