A refinance boom — born in a plummeting interest rate environment — is pushing down risk levels for fraud on a mortgage application, according to First American.

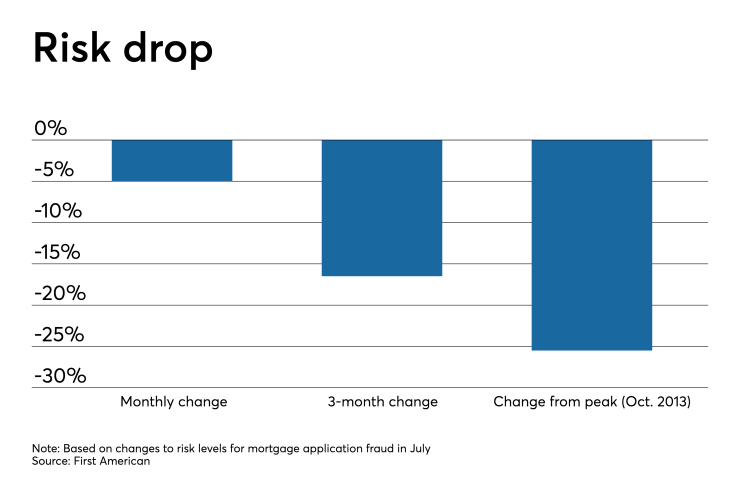

The frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications fell 5% in July from just the previous month, according to First American’s Loan Application Defect Index. The only time risk levels have been lower than July’s reading of 76 (the index is benchmarked to 100 in January 2011) was in October 2016.

“The 30-year, fixed mortgage rate has been declining since December 2018, and in July 2019 reached 3.8%, the lowest rate since November 2016. As mortgage rates fall, the incentive to refinance increases. For many homeowners, the most important consideration on whether to refinance or not is if the mortgage rate is sufficiently lower than their existing rate,” Mark Fleming, First American's chief economist, said in a press release.

“The prevailing mortgage rate of 3.8% in July triggered a 25% jump in refinances month over month and a 60% jump compared with July 2018. Why does this matter for fraud risk? Defect, fraud and misrepresentation risk is significantly lower on refinance transactions, so the reduced risk of fraud and misrepresentation in July is largely due to the increasing share of lower risk refinance transactions within the mortgage market,” he continued.