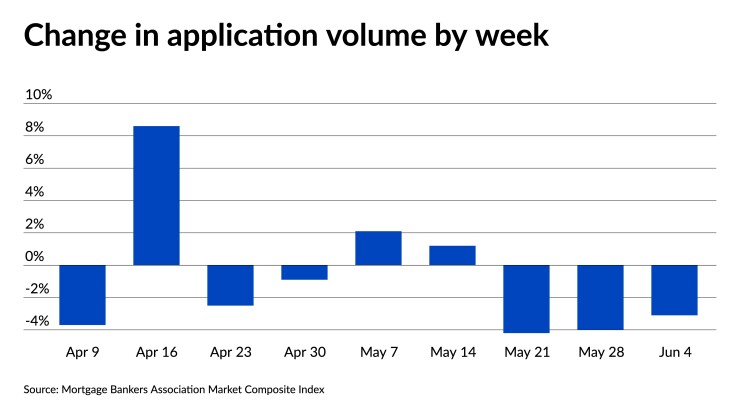

Mortgage volumes fell during a short holiday week in which purchases were up, but refinancing activity cooled off from early spring levels, according to the Mortgage Bankers Association.

The MBA’s weekly Market Composite Index, which measures mortgage volume based on the association’s survey of lenders, dropped a seasonally adjusted 3.1% week over week for the period ending June 4.

The Purchase Index inched upward, rising a seasonally adjusted 0.3% compared to the previous reporting period. On an unadjusted basis, purchases showed an 11% decrease week over week and was 24% lower than its level from the same week in 2020.

Although

Refinances took a 60.4% share of total application volume, compared with 61.3% a week earlier. “With fewer homeowners able to take advantage of lower rates, the refinance share dipped to the lowest level since April,” Kan said in a press statement.

The share of adjustable-rate mortgage applications increased to 3.9%, up from 3.7% the previous week.

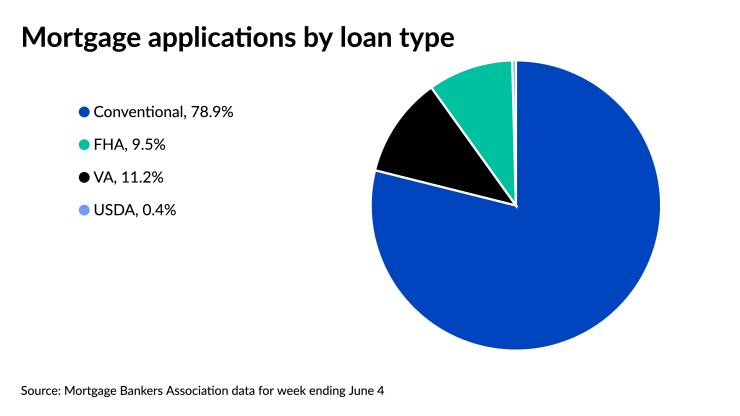

The share of Federal Housing Authority-backed loan applications inched down one basis point to 9.5% from 9.6% the prior week, while Veterans Administration mortgages went in the other direction, rising to 11.2% of total share volume from 10.9%. The share of loans backed by the U.S. Department of Agriculture remained at 0.4%.

Average loan size shrinks for purchases, increases overall

The average size of mortgages overall trended upward again, rising to $338,000 from $337,200 the week prior. The average purchase-mortgage amount dropped, however, decreasing to $407,000 from $408,300. For refinances, the average climbed to $292,900 from $292,400 week over week.

Although the average purchase-loan size fell for a second consecutive week, it is still well above its 2020 average of $353,900, Kan noted. “Home-price growth continues to accelerate, driven by favorable demographics, the recovering job market and economy, and housing demand far outpacing supply.”

Interest rates fall for 30-year mortgages

The contract interest rate of 30-year fixed-rate mortgages with conforming loan balances of $548,250 or less averaged 3.15%, compared to 3.17% a week earlier. The average contract interest rate of 30-year fixed-rate jumbo loans with balances greater than $548,250 also decreased to 3.29%, down from 3.34% the previous week.

For FHA-backed 30-year mortgages, the average rate dropped four basis points to 3.12% from 3.16%.

The average contract interest rate of 15-year fixed-rate mortgages declined as well, falling to 2.52% from the previous week’s 2.56%, while the 5/1 adjustable-rate mortgage average was unchanged week over week at 2.54%.