While Black Knight data revealed that home prices grew at a record pace in April due to both the housing inventory shortage and low interest rates, a separate report from Redfin found indicators of the housing market starting to cool in May.

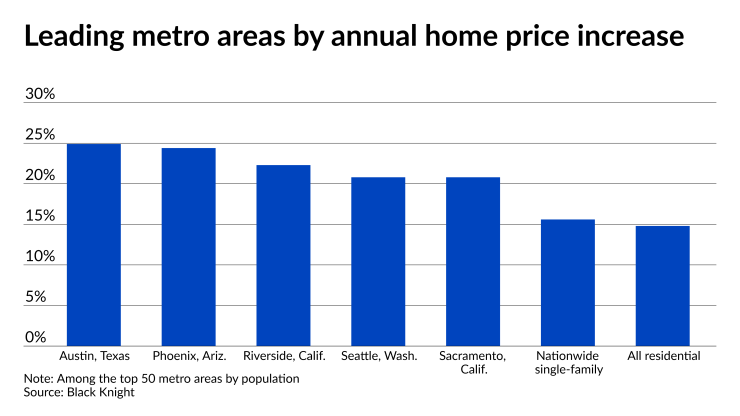

Residential home prices grew by 14.8% in April, the highest annual growth rate in the nearly 30 years that Black Knight has been tracking this metric. Single-family properties actually had higher price appreciation, at 15.6% on an annual basis, while condominium prices rose by 10%.

That marks 17 consecutive months of increased residential home prices.

The total number of active listings of homes for sale was down 60% from the 2017 to 2019 average for the month of April and "it's not getting any better, either," pointed out Ben Graboske, president of Black Knight Data & Analytics," in a press release.

Black Knight's own data found that there was just two months' worth of single-family inventory for sale nationwide in March, the lowest share on record, and that continued trending downward. "In fact, there were 26% fewer newly listed properties in April as compared to pre-pandemic seasonal levels," Graboske said.

Higher prices are resulting in lower affordability levels, even with the average interest rate for the 30-year fixed mortgage as measured by Freddie Mac slipping back under 3%

"Entering June, the share of the median income needed to make the monthly payments on the median-priced home had risen to 20.5%," said Graboske, who pointed out that while lower than the 25-year average of 23.6%, it was above the 5-year average of 20.1%

"In recent years, 20.5% has roughly been the tipping point at which appreciation begins to decelerate, but given the severity of inventory shortages, home prices have — at least for now — continued to sharply accelerate even in the face of tightening affordability," Graboske said.

If prices were to continue to rise at the current pace and the average for the 30-year FRM

But there are signs that a market slowdown may already be starting, and it might be a result of the pandemic restrictions lifting, Redfin said. Both pending sales and asking prices began to flatten in the four week period ended May 30.

"The housing market was going 100 miles per hour and now it's down to 80," said Redfin Chief Economist Daryl Fairweather in a press release. "This is not the bursting of a bubble. Rather, it's a sign that consumers might rather spend their time and money on other things besides housing now that travel, dining and entertainment are resuming in full force."

It's too early to know if this is just an early start to a normal seasonal housing pattern or the start of a post-pandemic cooldown, given that the time period in question ended the day before Memorial Day.

Pending home sales fell 3% from the four-week period

Meanwhile, seller asking prices fell $2,500 from the four-week period ending May 23 to a median of $354,975. This was up 11% from the same period in 2020.

But the completed sales during this period indicate May's market was still running hot.

There was a record-high rolling four-week average median home sale price of $355,558, up 24% (also a record) year-over-year.

A record high of 52% of homes sold for more than their list price, up from 26% the same period a year earlier.

And they sold at a 102.0% average sale-to-list price ratio (another record), which means that the average home sold for 2.0% more than its asking price. A year ago, they sold for an average of 1.5% below asking.

The time from listing to sale fell to a record low of 16 days, down from 37 days for the same period in 2020.