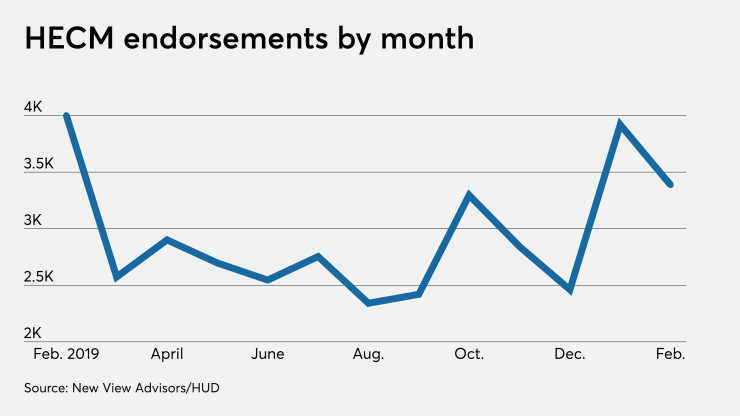

Endorsements of Home Equity Conversion Mortgages fell nearly 14% on a consecutive-month basis in February after a January surge, but stayed relatively strong compared to average levels last year.

HECM endorsements fell to 3,386 last month after hitting an 11-month high in January, according to New View Advisors'

"It is lower than last month's 3,919, but adjusted for day count a very strong number considering the previous 12 months averaged fewer than 2,900 units," according to New View Advisors.

Monetary policy reactions to the coronavirus that intensified the

Housing wealth held by seniors eligible to apply for reverse mortgages insured by the Federal Housing Administration is at a record high, according to the National Reverse Mortgage Lenders Association's latest numbers. Consumers who are 62 or older are eligible to apply for HECMs, which constitute the bulk of loans in the reverse-mortgage market. This demographic held almost $7.2 trillion in housing wealth in the third quarter of 2019.

Reverse mortgages were designed to allow seniors to live in their homes and tap their equity without placing undue payment stress on them, given that they may be retired and living on fixed incomes.

From a servicing and financial perspective, reverse mortgages have not performed as well as other single-family loans in the FHA's book of business, but their risk has been offset by